Sell Your Mobile Home Today!

Do You Live in a Kort & Scott Mobile Home Park?

If you own a mobile home in a Kort & Scott Financial Group (KSFG) dba Sierra Corporate Management (SCM) managed and/or owned mobile home park, you may now find yourself stuck there. Your monthly space rent and utilities have probably risen to the point where you cannot afford to live there anymore but, you cannot afford to move either. Along with rising rents, there is a good chance that the quality of life has diminished in your park and you don’t know what to do – you feel trapped. You’re in what is referred to as a “Catch 22 Situation”.

You are now in a losing proposition. Your rent will continue to increase, probably at a minimum of 6.0% per year. Your water, sewer and trash utilities will continue to increase. The value of your mobile home will continue to decrease. And usually, the value of the land increases during this process. This is a win/lose situation – with YOU, the homeowner, being the loser.

At this stage you have a handful of options available to you. If Kort & Scott recently purchased your park, this writer STRONGLY suggests that you sell your mobile home and GET OUT NOW before you're trapped in there and cannot sell your home.

As soon as the first SCM major rent increase goes into effect (e.g. $650/Month to $950/Month), you will be in a losing situation from that point forward. It won't be long before you are in the same situation as thousands of others who have fallen prey to the predatory business model of Kort & Scott Financial Group (KSFG) dba Sierra Corporate Management (SCM) aka 223 other dbas.

Option 1 – Put Your Mobile Home Up for Sale TODAY!

For many mobile home owners this may not be an option you would have ever considered before Kort & Scott Financial Group purchased your park and Sierra Corporate Management took over management of the park - but you're at that juncture now and are ready to get out. Take a look around your park and answer these questions...

- How many mobile homes are for sale in your park?

- How many of those are "Affiliate Owned Mobile Homes" aka "Park Owned Mobile Homes"?

- How many mobile homes have gone up for sale since KSFG purchased your park?

- How much is your monthly space rent?

- How much was your last space rent increase?

- How much is monthly space rent for new buyers of "Resident Owned Mobile Homes?"

- How much is monthly space rent for new buyers of "Park Owned Mobile Homes?"

In most instances, the difference between Park Owned and Resident Owned space rents are significant and will be a major interference with the sale of your mobile home so be prepared to sell at a deep discount. Trust me, if you don't make the sale "extremely appealing" to a new buyer, your home will remain on the market for a long time. Just get it over with and get out of there as soon as you can.

For example, in 2014, in the Tustin Village Mobile Home Park, new buyers were faced with $1,600+ per month space rents. They had to prove monthly income three times (3x) that amount or $4,800. If they were purchasing a "Park Owned Mobile Home" there was/is a space rent special of $1,150 per month for the first year, $1,250 per month for the second year and $1,600 per month for the third year. This adds up to an estimated savings of $18,600 over three (3) years if purchasing a park owned home.

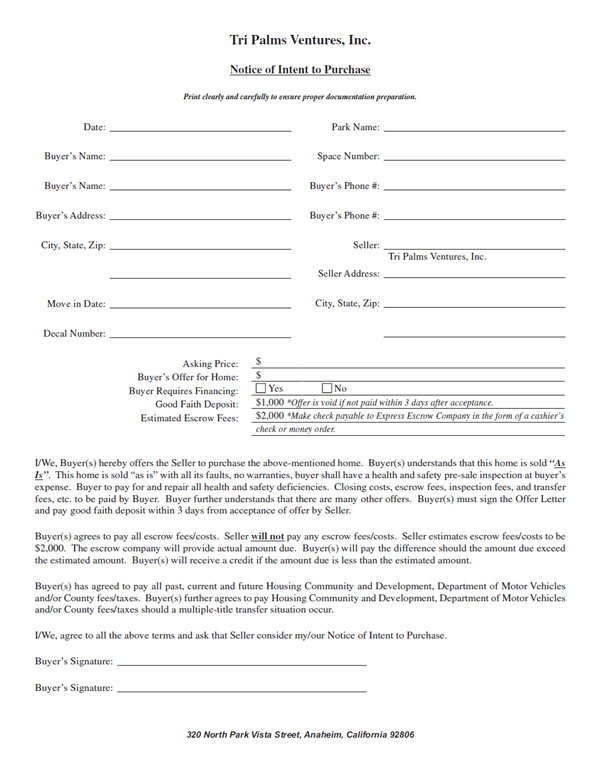

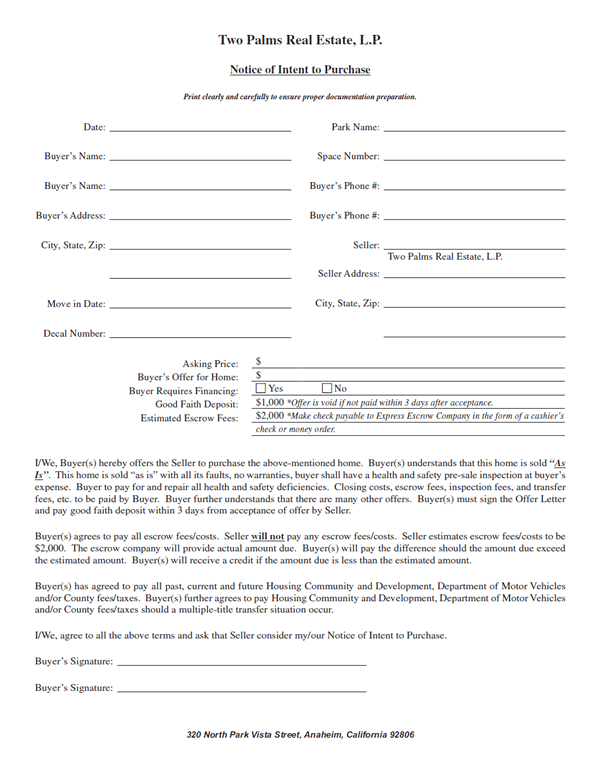

There's also a chance that park management may interfere with the sale of your mobile home using various methods. They may hang banners outside the park entrance reading "Homes for Sale" along with their phone number(s) and/or a phone number for a Retailer who is an employee of a Kort & Scott Financial Group dba, in Tustin Village it was Two Palms Real Estate.

Be careful with whom you select to assist you in listing your mobile home for sale. Many of the Retailers that have been and/or are selling homes in KSFG parks may have special arrangements with park management that may not be in your best interest. If you find that the majority of homes for sale in your mobile home park are listed by one Retailer, that may be a strong indicator that there are special arrangements with Sierra Corporate Management.

Mobile Home Value Note: Your mobile home is not worth what you may think it is. If you're in a KSFG/SCM managed or owned mobile home park, the value of your mobile home may have significantly decreased every year since they purchased and/or took over management of your park. The general industry rule of thumb is that for every $10 per month rent increase, you lose $1,000 in mobile home equity.

If you have an older mobile home, more than 25 years old, there's a good chance that it is not worth $10,000, especially if you're in a Kort & Scott park. You may also find that your mobile home cannot be resold due to its age and/or current condition. It would need to be removed from the space upon your departure.

Must Read: Laws Governing Inspection and Removal of Older Homes upon Resale in California’s Mobilehome Parks (PDF 8 Pages)

Option 2 – Sell Your Mobile Home to the Park

Kort & Scott Financial Group (KSFG) dba Sierra Corporate Management (SCM) and/or one of its affiliates may purchase your mobile home if it is in saleable/inhabitable condition. They know you're in a "Catch 22 Situation" and will offer you a fraction of what it may be worth. For example, you may be selling your mobile home for $30,000 and SCM may offer you $3,000.

If your mobile home is paid off, this may be a "last resort" sale option and one that this writer would recommend if you need to get out now, just take the park offer and get out of there now while you still can – while you still have your mental capacities aka – sanity.

Option 3 – Move Your Mobile Home to Another Park

If your mobile home has significant value and you cannot sell it, you may want to consider moving it to another park. This option is probably not something this writer would recommend. First you need to locate an empty space, those are hard to come by these days in California. Many mobile home parks will not allow used mobile homes to be installed. If you find an available space, it will need to be prepared for your mobile home. Depending on the size of your home, these preparation costs could be expensive.

You also have the cost of transporting your home from one mobile home park to another. This can be anywhere from $10,000 to $30,000+ depending on the size of your mobile home. If your mobile home is more than fifteen to twenty (15-20) years old, it's not moveable, it will most likely incur structural damage during transport that you will be responsible for. This writer can tell you from personal experience that after all is said and done with, once you install a mobile home the first time, from the factory, and it settles, it's there to stay, you don't want to move it a second time.

There's also the chance that once you move your mobile home to another park and settle in, Kort & Scott Financial Group or a similar corporate entity may purchase it. Do you feel trapped? You are.

Option 4 – Sell Your Mobile Home to a Specialist

There are companies that will buy your mobile home at "way below market value" and move it elsewhere. Many times these mobile homes find their way across the border into Mexico where they become a new home for someone in need. Check with other residents in your park to see if they are familiar with a local company who may buy and remove your mobile home.

Option 5 – Sell Your Mobile Home to a Salvage Company

Do a search in your favorite search engine for Mobile Home Salvage Companies in your local area.

Option 6 – Walk Away from Your Mobile Home

Last Resort: Foreclosure – If you are in a situation where none of the above options are viable, you may have to walk away from your mobile home. Keep in mind that this should be a last resort after all of the other options have been exhausted. If you have a mortgage that you are defaulting on, this option will damage your credit for the next 7 years so be prepared if you decide to go this route. You should have a Plan A and Plan B in place if you walk away from your mobile home.

If you own your mobile home and walk away from it, you will be responsible for the costs associated with removing it if it needs to be removed. If you could not sell to the park and could not sell to a specialist and you don't want to salvage it, then it's probably not worth it and your only choice is to walk away. Again, if you own your home, this writer would strongly suggest that you find a way to remove the home yourself. If you don't, you could end up with a judgment against you for the costs associated with removing the home after your departure.

If you do not own your mobile home and have a mortgage payment, contact your lender and see if they can offer a reduced mortgage payment to offset the increase in rent. If not, let them know you would like to do a voluntary foreclosure. Allow them to prepare for your departure, don't just go into default and make them come after you, this writer would strongly advise against that. Work with your lender as much as you can. Once they find out you're going to walk away, they may find a way to provide some assistance and help you remain there until a later date. It's unfortunate because you're still in the "Catch 22 Situation" and at some point, you'll be faced with this decision again.

Stop Predatory Park Owners

Notice of Intent to Purchase

Tri Palms Ventures, Two Palms Real Estate

Homes for Sale

Sierra Corporate Management Banners

If you're a mobile home owner selling your home in an SCM managed mobile home park, your primary competition may be a Kort & Scott affiliate.

Park Owned Homes for Sale

Sierra Corporate Management Banners