Sierra Corporate Management A Kort & Scott Company

Non-Receipt of Mobile Home Title

Register Your Mobilehome California Hits Milestone

Helping Mobilehome Owners Save More than $1 Million in Back Fees and Taxes

Thu, Jul 19, 2018 – Register Your Mobilehome California, a limited-term state program waiving past-due registration fees and taxes for mobilehome and manufactured homeowners hit a major milestone in July, having saved homeowners more than $1 million since its launch in 2017.

Register Your Mobilehome California, administered by the California Department of Housing and Community Development (HCD) allows people who acquired a mobilehome or manufactured home but didn't get the proper registration to obtain current title and registration without paying back taxes and fees. The program is saving owners hundreds or even thousands of dollars.

State officials estimate as many as one of every three mobilehome owners may be able to benefit from Register Your Mobilehome California.

The program gives owners the opportunity to register their property and avoid paying back fees and taxes, while also ensuring their families have a secure and stable place to call home," said HCD Director Ben Metcalf. Homeowners have the opportunity to get proper title and registration, while saving money and getting peace of mind.

Mobilehome and manufactured homeowners can take a quick test to find out if they could be eligible. Potential applicants can also view a 15-minute video explaining how to apply.

Because the program is set to expire December 31, 2019, mobilehome owners are encouraged to apply as soon as possible.

Register Your Mobilehome California – Overview and Application Instructions

Mon, Nov 7, 2016 – Are you without the title to your mobile home? Have you made a diligent effort in obtaining your title from the seller? Have you found out that there are property tax liens against the mobile home you paid for and that you cannot obtain your title until those liens are paid for in full?

Assembly Bill 587 which was passed by Governor Brown on Wed, Sep 21, 2016, creates a tax abatement program for mobile home owners who cannot transfer title of ownership into their names, due to tax delinquencies incurred by prior owners.

Are you eligible to waive past-due registration fees or local property taxes for your mobilehome? Find out if you could qualify for Register Your Mobilehome California: A Fee and Tax Waiver Program. You may be eligible to waive hundreds of dollars and get current registration and title for your manufactured home/mobilehome.

(1) Existing law subjects manufactured homes or mobilehomes sold as new prior to July 1, 1980, to a vehicle license fee and requires annual payment of the fee. Existing law provides that nonpayment of certain fees and penalties, including the vehicle license fee, constitutes a lien on the manufactured home or mobilehome, and prohibits the Department of Housing and Community Development (department) from, among other things, issuing a duplicate or new certificate of title or registration card or amending the permanent title record of the manufactured home or mobilehome that is the subject of that lien.

This bill, when a person who is not currently the registered owner of a manufactured home or mobilehome applies to the department for registration or transfer of registration of the manufactured home or mobilehome prior to December 31, 2019, and meets other specified requirements, would require the department to waive all outstanding charges assessed by the department prior to the transfer of title of the manufactured home or mobilehome, release any lien imposed with respect to those charges, issue a duplicate or new certificate of title or registration card, and amend the title record of the manufactured home or mobilehome.

(2) Existing law provides that mobilehomes and manufactured homes not subject to the vehicle license fee are subject to local property taxation, and requires the department to withhold the registration or transfer of registration of any manufactured home or mobilehome subject to local property taxation until the applicant for registration presents a tax clearance certificate or conditional tax clearance certificate issued by the tax collector of the county where the manufactured home or mobilehome is located. Existing law requires the county tax collector to issue a tax clearance certificate or conditional tax clearance certificate if specified requirements are met.

This bill, when a person who is not currently the registered owner of a manufactured home or mobilehome subject to local property taxation applies to the department for registration or transfer of registration of the manufactured home or mobilehome prior to December 31, 2019, and meets other specified requirements, would require the department to issue a conditional transfer of title. The bill would require a county tax collector to issue a tax liability certificate to a person with a conditional transfer of title who applies for the certificate prior to January 1, 2020. Pursuant to the constitutional authorization described above, this bill would require the payment of only a portion of the taxes, as specified, reasonably owed from the date of sale of the manufactured home or mobilehome. By increasing the duties of county tax collectors, this bill would impose a state-mandated local program.

HCD Implementation of Assembly Bill 587

Mon, Nov 7, 2016 – AB 587, sponsored by GSMOL, was signed into law this year. It allows for the transfer of title of a home despite delinquent taxes of a previous owner. GSMOL recently attended a meeting at HCD regarding HCD’s initial plans to implement the legislation. Worth noting:

- While the bill goes into effect on January 1, HCD is looking to start after July 1 when they anticipate regulations will be in place. HCD stated regulations are needed before issuing forms and charging fees associated with the application process.

- HCD is also looking to initially outreach to a few counties in Northern and Southern California and are open on how to partner with advocacy groups in outreach, education, and implementation.

- HCD is working on the assumption that 16,000 homeowners will apply each year for the 3 years the law is in effect. That is approximately 30% of the 160,000 homes in the state that are not properly registered.

California AB 587 – Mobilehomes: Payments: Nonpayment or Late Payments

Wed, Sep 21, 2016 – Governor Signs GSMOL Co-Sponsored Bill Granting Tax Relief to Mobilehome Owners – Today, Governor Brown signed AB 587, authored by Assemblymember Ed Chau (D-Monterey Park), which creates a tax abatement program for mobile-home owners who cannot transfer title of ownership into their names, due to tax delinquencies incurred by prior owners.

Assembly Bill No. 587, Chapter 396 – An act to amend Section 798.15 of the Civil Code, to amend Sections 18092.7, 18116.1, and 18550 of, and to add Section 18550.1 to, the Health and Safety Code, and to amend Section 5832 of the Revenue and Taxation Code, relating to mobilehomes.

Did you buy a mobile home in a Kort & Scott Financial Group (KSFG) dba Sierra Corporate Management (SCM) managed mobile home park?

If you purchased your mobile home in a KSFG owned, and SCM managed mobile home park, and you did not handle the transaction with an ethical Licensed Real Estate Broker or an HCD Licensee, there is a possibility that you are without the Title (or its equivalent) to your mobile home after purchase.

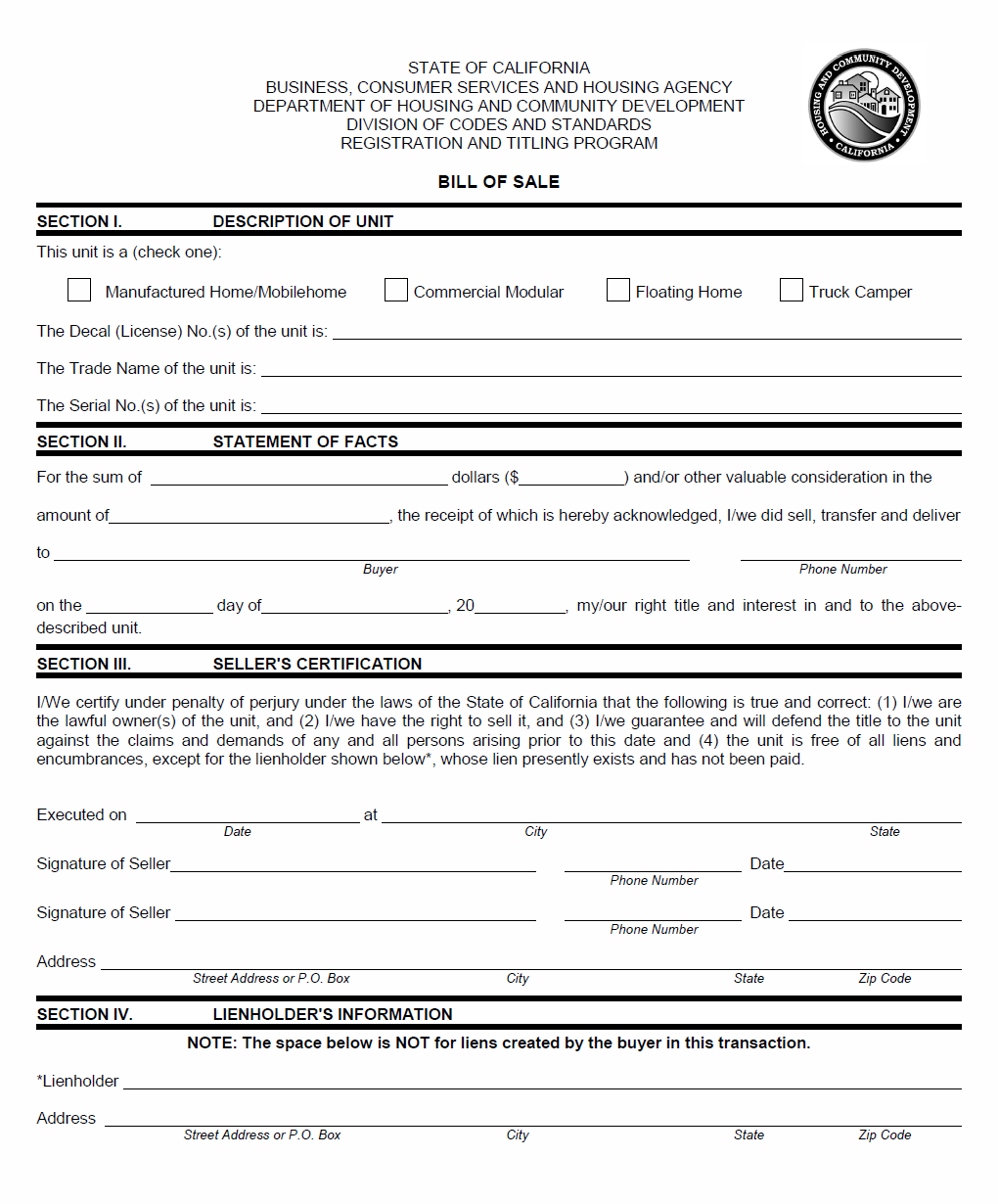

If the mobile/manufactured home has been “paid in full” and there are no current Liens the owner will have an original state Title(s) (or its equivalent) in his or her possession. Verify on the Title itself that the Lien section is blank or released of lien by lien holder.

If you are reading this document, there is a strong possibility that you are having challenges acquiring the Title to your mobile home that you purchased in a Sierra Corporate Management managed mobile home park. Here are some questions that we have for you...

- How long has it been since you purchased your mobile home?

- Did you receive the Title to the mobile home at time of purchase?

- If you DID receive your Title, was it free and clear of liabilities? For example, were there any past due property taxes? If so, how much were they?

- If you DID NOT receive your Title, what steps have you taken to obtain it?

- How many times have you asked the seller of the mobile home for the Title?

Your answers to the above questions will determine the steps you need to take next. If you are without your title, and it has been 1, 2 or even 3 years or more since you purchased your mobile home, there is a possibility that you owe past due property taxes on the mobile home.

How Come You Owe Past Due Property Taxes?

How did this happen? How come you owe all of these past due property taxes? Our guess is that the mobile home you purchased may have been confiscated after the departure of a resident who may have failed to pay rent or, they just walked away from their home due to the financial hardship imposed on them by Sierra Corporate Management. There may have been property taxes owed at the time the resident surrendered the mobile home.

Certain assessments are by law entered on the secured roll, but when delinquent become subject to unsecured collections provisions. Typical examples of such assessments include mobilehomes and structural improvements on leased land.

Orange County, California – Unsecured Property Taxes

These confiscated or surrendered mobiles homes are often resold with legalese in the Bill of Sale that leaves you, the new mobile home owner, responsible for paying these past due property taxes. This may or may not be disclosed during the sale transaction of the mobile home.

Many mobile home owners, who purchased their mobile home in a Sierra Corporate Management managed mobile home park, find that when they attempt to get a copy of the Title from a county department, there are past due property taxes owed on the mobile home. The Title will not be released until those past due property taxes are paid in full.

Be advised, the amount of past due property taxes could be more than the mobile home value. We have personally met and talked with residents in multiple KSFG/SCM mobile home parks who have been faced with past due property taxes in excess of $5,000. These residents were not aware, and were not informed of these past due property taxes until they inquired about obtaining a copy of the title to their mobile home from a county office.

Are You Seeking Justice? Want Your Title?

Violation of Health and Safety Code §18080.4(a)

(a) Every registered owner, upon receipt of a registration card, shall maintain the card or a copy thereof with the manufactured home, mobilehome, commercial coach, truck camper, or floating home for which it is issued.

Health and Safety Code Section §18080.4

Every mobilehome owner must have a copy of the current registration for their home.

If your complaint is against a Real Estate Agent/Broker, Contractor or a Private Party, these are not handled by the HCD. You must now take legal action to secure your Title from the seller. We've provided information and links below to assist you in your attempt to obtain the Title to your mobile home.

Complaints Against Real Estate Agents/Brokers

Complaints Against Contractors

Complaints Involving Private Party Sales

You may want to seek qualified legal advice from a licensed attorney or legal aid group. You may be able to qualify and obtain legal advice from a legal aid group. Finding a free or low cost lawyer is difficult because there are a lot of people who need lawyers but cannot afford them. Here are the main groups that may be able to help you.

- Free and Low-Cost Legal Help (English/Español)

California Courts – Small Claims Advisors

Click/tap on your County to find your Court's Small Claims Advisor information. If you do not know your county, input your city or zip code in the Find Your Court box and you will get a link to your County's Superior Court.

We've listed ten (10) counties first in order as these are where Kort & Scott Financial Group (KSFG) dba Sierra Corporate Management (SCM) mobile home parks are located.

HSC §18080.4(a)

Every registered owner, upon receipt of a registration card, shall maintain the card or a copy thereof with the manufactured home, mobilehome, commercial coach, truck camper, or floating home for which it is issued.

Health and Safety Code Section §18080.4

Every mobilehome owner must have a copy of the current registration for their home.

Your Decal Number can be located on a Registration Renewal Billing Notice, Registration Card and/or you should have an HCD Decal affixed to your mobile home that displays your Decal Number, see examples at the link above.

Sin Título de tu Casa Móvil? Póngase en contacto con el Departamento de la División de Vivienda y (HCD) de Registro de Desarrollo Comunitario y Titulación de Estado al 800-952-8356 para obtener asistencia inmediata.

No Title for Your Mobile Home? If you have not received your Title within twenty (20) days after purchase, contact the State Department of Housing and Community Development’s (HCD) Registration and Titling Division at 800-952-8356 for immediate assistance.

MRL FAQ – 63.1. Selling Mobilehomes: Realtor’s License and Clean Titles

Question: I own a mobilehome park where there are many abandoned homes. Can I sell them without registering as a real estate agent?

Answer: Generally, the answer is “no”. First, in order to act as an agent between a seller or buyer of a used mobilehome or manufactured home, you either must be registered with HCD as a “manufactured home dealer” or with the Bureau of Real Estate as a licensed real estate agent. Acting as an unlicensed dealer or agent can result in criminal penalties, civil penalties, and citations of up to $2,000 for each illegal sales activity.

The only exception to this is if the prior residents/homeowners have “walked away” from the homes, a park owner may sell them if he/she first obtains the right to ownership through a court action for the judgment of abandonment (Civil Code Section 798.61) or after a warehouse lien sale (Civil Code Section 798.56a). After that, if the park owner intends to rent, sell or salvage the units, the park owner must go to HCD and transfer title to his or her name, which includes paying all property taxes or HCD fees that are owed. HCD also has special procedures for when the prior registered owner cannot be found or when there are unpaid or unsatisfied loans on the home. Only after registering as the new owner may the park owner (who is now the homeowner) rent, sell, or salvage the abandoned homes.

Recap:

- Only HCD-licensed dealers or BRE-licensed real estate agents may sell used manufactured homes in a park. Exception: When previous owner has “walked away”, park owner must follow legal procedures governing judgment of abandonment or warehouse lien sale.

- It is illegal for anyone to sell, rent, or salvage a manufactured home that is not registered in his or her name.