California MHP News

Mobile Home Owner News – Dec 2016

Resident curated news and important information regarding mobile home owners and residents in mobile home parks throughout the State of California.

Click/tap the story headlines to open a link to the full original story. Story headlines with are inline news stories.

Clicking or tapping links with a caret (kar-it, carrot) will expand/show additional content and change to to collapse/hide content. Content that is collapsed/hidden will not print.

Sat, Dec 31, 2016 – The MHPHOA online version of the 2017 California Mobilehome Residency Law in HTML has been updated to reflect all changes. We’ve also updated the MHPHOA online version of the 2017 California MRL FAQs in HTML.

2017 California Mobilehome Residency Law

Sat, Oct 29, 2016 – 2017 California Mobilehome Residency Law Handbooks are now available.

From the Senate Select Committee on Manufactured Home Communities:

Division 2, Part 2, Chap. 2.5 of the Civil Code. The Mobilehome Residency Law (MRL) is the “landlord-tenant law” for mobilehome parks, which, like landlord-tenant law and other Civil Code provisions, are enforced in a court of law. The Department of Housing and Community Development (HCD) does not have authority to enforce violations of the MRL.

Senate Select Committee on Manufactured Home Communities

From the 2017 MRL Introduction:

For the 2017 edition, there is one new amendment to the Mobilehome Residency Law (see 798.15). The FAQs section has been expanded to include three new questions: the role of county adult protective services (#32.1); an explanation of the difference between trained service dogs and emotional support animals (#35.1); and the legal procedure for sales of abandoned mobilehomes (#63.1). The Index has been expanded, revised and enlarged.

Hollydale Mobile Home Park – 13% Eviction Rate in 2015

Fri, Dec 30, 2016 – The MHPHOA have been reviewing gigabytes of data regarding Kort & Scott including but not limited to; Civil Lawsuits (10+), Small Claims Lawsuits (50+), Unlawful Detainer Lawsuits (600+) and Mobile Home Sales (800+) in the Kort & Scott mobile home inventory.

While reviewing the data en masse, a timeline of events start to appear, stories begin to emerge, a predatory business model begins to take shape and is exposed. All of the Kort & Scott mobile home parks in California are experiencing a wide range of issues. There are a number of mobile home parks that raise red flags when running our reports and one of those is Hollydale Mobile Home Park, 1 of 33 mobile home parks in California owned by a Kort & Scott company and managed by Sierra Corporate Management.

The Hollydale Nightmare

Hollydale Mobile Home Park is a family park with 134 spaces located at 5700 Carbon Canyon Road, Brea, California 92823. The 2016 space rent is currently at $1,650 based on sales listings online. Hollydale Mobile Home Park (Space 53) was the previous corporate headquarters for Sierra Corporate Management.

Online records indicate that the residents of Hollydale Mobile Home Park won a 2009 Civil Lawsuit against the Kort & Scott DBA that owns their mobile home park for: Nuisance, Breach of Contract, Breach of the Covenant of Good Faith and Fair Dealing, Prima Facie Tort of Willful Conduct, Negligence, Negligence Per Se, Unfair Business Practices, Declaratory and Injunctive Relief.

Since the Civil Lawsuit and other ongoing (in progress) litigation activity, there have been a large number of what appear to be Retaliatory Evictions taking place in the mobile home park.

The Statistics – 44% Turnover in 21 Months

During the 2015 year, there were 17 Unlawful Detainer Lawsuits filed against a total of 29 homeowners and residents – that’s 13% of the 134 spaces in 12 months. Hart | King, A Professional Corporation, the law firm representing Kort & Scott DBAs, litigated all 17 eviction proceedings.

From Aug 2015 thru Nov 2016, 42 mobile homes have listed for sale – that’s 31% of the 134 spaces in 15 months with 34 of those mobile homes listed in 2016.

In total, there have been 59 mobile homes involved in a sale and/or eviction proceeding since Feb 2015 – that’s 44% of the 134 spaces in 21 months.

Hollydale Mobile Home Park

- Address: 5700 Carbon Canyon Road, Brea, California 92823

- County: Orange

- Phone: 714-528-7779

- Spaces: 134

- Type: Family

- 2016 Space Rent: $1,650

- Refinanced: Jun 2005, Amount: $94,700,000, 3/6 MHP Package

Loan Type: Fannie Mae FRM, Chad Thomas Hagwood - Refinanced: Dec 2013, Amount: $158,000,000, 3/8 MHP Package

Loan Type: Fannie Mae FRM, Chad Thomas Hagwood - Management: Sierra Corporate Management

- DBA: Hollydale Lowertier/Partner LP, Hollydale Uppertier/Operating LP

- DBA Filing: Sep 2001

Mobile Home Sales – Blue Carpet Manufactured Homes

Thu, Dec 29, 2016 – One question that has been continually asked by residents is how can the Real Estate Agents sell mobile homes in Kort & Scott parks knowing what is happening and what the outcome may be? If they were Realtors, they may be in violation of their licensing requirements and Code of Ethics which states this…

REALTORS® having direct personal knowledge of conduct that may violate the Code of Ethics involving misappropriation of client or customer funds or property, willful discrimination, or fraud resulting in substantial economic harm, bring such matters to the attention of the appropriate Board or Association of REALTORS®.

But, these are not Realtors that we are discussing, these are individuals who have an HCD Occupational License which allows them to legally sell mobile homes in the State of California. The Occupational Licensing Program is administered exclusively by the California Department of Housing and Community Development.

The MHPHOA believe that the high volume retailers in Kort & Scott owned mobile home parks have “direct personal knowledge” of the park owner’s predatory business practices. One such retailer is Blue Carpet Manufactured Homes located at 10231 Slater Avenue, Suite 115, Fountain Valley, California 92708-4745, 714-636-6666.

The MHPHOA believe these high volume retailers should have their Occupational Licenses revoked. It is time to put a stop to this predatory business model and it all starts with the sales of mobile homes.

Mobile Home Sales – Monarch Home Sales

Wed, Dec 14, 2016 – The MHPHOA believe that the high volume retailers in Kort & Scott owned mobile home parks have “direct personal knowledge” of the park owner’s predatory business practices. One such retailer is Monarch Home Sales located at 8907 Warner Avenue, Suite 151, Huntington Beach, California 92647-8303, 714-916-0310.

Wed, Dec 28, 2016 – The MHPHOA would like to respectfully remind Hart | King Law, Dowdall Law Offices, and all other “culpable” attorneys representing mobile home park owners and practicing law in the State of California, you do have a Rules of Professional Conduct that you must adhere to. If you violate these Rules of Professional Conduct, you may be subject to disbarment.

California is the only state in the nation with independent professional judges dedicated to ruling on attorney discipline cases. The State Bar of California investigates complaints of attorney misconduct. If the State Bar determines that an attorney’s actions involve probable misconduct, formal charges are filed with the State Bar Court by the bar’s prosecutors (Office of Chief Trial Counsel).

The independent State Bar Court hears the charges and has the power to recommend that the California Supreme Court suspend or disbar attorneys found to have committed acts of professional misconduct or convicted of serious crimes.

Also, it can temporarily remove lawyers from the practice of law when they are deemed to pose a substantial threat of harm to clients or the public.

The State Bar Court of California

What is Moral Turpitude

Moral Turpitude is a phrase used in criminal law to describe conduct that is considered contrary to community standards of justice, honesty, or good morals. Turpitude means a corrupt, depraved, degenerate act or practice. Moral turpitude generally refers to conduct that shocks the public conscience.

Disbarment – California Business and Professions Codes §6106 and §6107

-

6106. The commission of any act involving moral turpitude, dishonesty or corruption, whether the act is committed in the course of his relations as an attorney or otherwise, and whether the act is a felony or misdemeanor or not, constitutes a cause for disbarment or suspension.

If the act constitutes a felony or misdemeanor, conviction thereof in a criminal proceeding is not a condition precedent to disbarment or suspension from practice therefor.

- 6107. The proceedings to disbar or suspend an attorney, on grounds other than the conviction of a felony or misdemeanor, involving moral turpitude, may be taken by the court for the matters within its knowledge, or may be taken upon the information of another.

California Business and Professions Code Section 6100-6117

CIMT – Crimes Involving Moral Turpitude

Crimes Against Property: Accessory Before the Fact in Uttering a Forged Instrument, Attempted Fraud, Conspiracy to Commit Forgery, Encumbering Mortgaged Property with Intent to Defraud, Extortion, Forgery, Making False Statements of Financial Condition, Malicious Trespass, Obtaining Money by False Pretenses, Uttering a Forged Instrument

Tue, Dec 27, 2016 – On Tue, Mar 1, 2016, an open letter from Nancy Duffy McCarron, CBN 164780, was sent to Kamala Harris, the Attorney General of California. The opening paragraph reads…

Open Letter on Behalf of the People of the State of California

On behalf of the PEOPLE of the STATE of CALIFORNIA we petition an investigation of an ongoing racketeering enterprise orchestrated by Robert Williamson, Ryan Egan, John Pentecost and others at HART|KING, 4 Hutton Center Drive, St 900, Santa Ana, CA 92707. The enterprise was designed to steal mobile homes in California and Western United States to enrich wealthy park owners. Park owners pay HART|KING to prosecute unlawful evictions to steal homes from private owners who are rendered homeless after this grand theft of assets.

HART|KING orchestrates this racketeering enterprise to steal mobile homes by: Continue Reading…

Note: Hart | King, A Professional Corporation located at 4 Hutton Centre Drive, Suite 900, Santa Ana, California 92707, is the law firm used by Kort & Scott dba Sierra Corporate Management (SCM) to nefariously evict mobile home owners stripping them of their financial assets in the process.

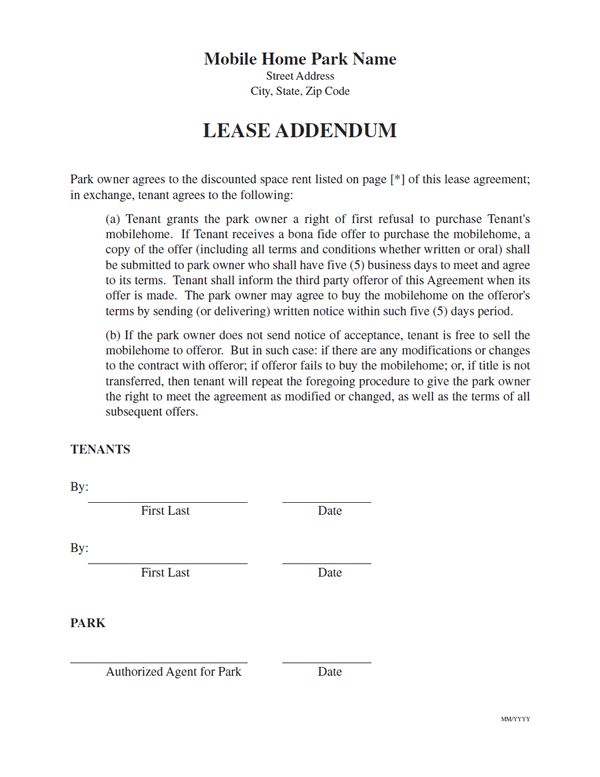

Interference with Mobile Home Sales – Kort & Scott Mobile Home Parks

Mon, Dec 26, 2016 – What are your chances of selling your “resident owned mobile home” for what it’s worth in a mobile home park owned by Kort & Scott and managed by Sierra Corporate Management? “Slim to none” is the expression we hear when that question is answered by those who have attempted to sell their mobile home for what it is worth and, within a reasonable timeframe.

Many of the resident owned mobile home sales we’ve researched have resulted in the mobile homes being sold for a fraction of their value to a Kort & Scott affiliate and/or being removed from the park by a broker who specializes in purchasing and removing distressed mobile homes.

There are a number of reasons why you may not be able to sell your mobile home in a Kort & Scott mobile home park including but not limited to…

- Space Rent Increases

- Long-Term Lease Agreements with Right of First Refusal

- Forbearance Agreements with Right of First Refusal

- Park Management Interference

- Space Rent Specials for Park/Affiliate Owned Homes

- Income Requirements for Prospective Tenants

- Listing Mobile Homes for Sale with Kort & Scott Affiliated Retailers

- Mobile Home Park Degentrification

Happy Holidays from Southern California!

Sat, Dec 24, 2016 – If you own a mobile home in a Kort & Scott Financial Group (KSFG) dba Sierra Corporate Management (SCM) managed and/or owned mobile home park, you may now find yourself stuck there. Your monthly space rent and utilities have probably risen to the point where you cannot afford to live there anymore but, you cannot afford to move either. Along with rising rents, there is a good chance that the quality of life has diminished in your park and you don’t know what to do – you feel trapped. You’re in what is referred to as a “Catch 22 Situation”.

You are now in a losing proposition. Your rent will continue to increase, probably at a minimum of 6.0% per year. Your water, sewer and trash utilities will continue to increase. The value of your mobile home will continue to decrease. And usually, the value of the land increases during this process. This is a win/lose situation – with YOU, the homeowner, being the loser.

At this stage you have a handful of options available to you. If Kort & Scott recently purchased your park, this writer STRONGLY suggests that you sell your mobile home and GET OUT NOW before you’re trapped in there and cannot sell your home.

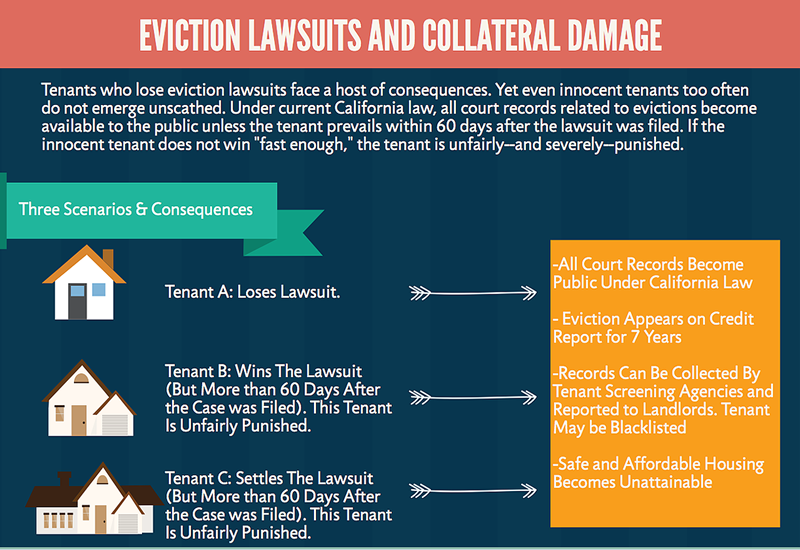

Fri, Dec 23, 2016 – If an Unlawful Detainer Lawsuit is filed against you (the registered mobile home owners and/or occupants), it could result in a judgment against ALL of you which may include monetary amounts, attorney fees, and other court costs as permitted by the California Mobilehome Residency Law §798.56a.

Once a lawsuit is filed with the court, it becomes public record and may appear on your Credit Report later or, have a negative impact on your credit even if no judgment is entered against you or the lawsuit is later dismissed.

As required by law, you are hereby notified that a negative credit report reflecting on your credit record may be submitted to a credit reporting agency if you fail to fulfill the terms of your credit obligations. This could seriously affect your ability to obtain credit or rental housing in the future.

California AB 2819 – Tenant Privacy Protections Passed

Fri, Sep 16, 2016 – Good news! Governor Jerry Brown just signed AB 2819* to protect the privacy, credit, and reputation of tenants who are involved in eviction lawsuits. It is a commonsense and much-needed reform to make sure that only tenants who lose an eviction lawsuit end up with an eviction on their record. Many tenants ended up with bogus evictions on their record just because their settlement agreement didn't ensure their privacy or the eviction process took longer than 60 days. An eviction on your record means your credit is ruined for years.

This bill is co-sponsored by Western Center on Law & Poverty (WCLP) and the California Rural Legal Assistance Foundation.

Wed, Dec 21, 2016 Updates – Over 100+ reviews and complaints from Sierra Corporate Management residents, SCM employees, buyers and sellers of mobile homes, City Council Members and other officials. These are mobile home parks in California managed by Sierra Corporate Management (SCM) and owned by a Kort & Scott Financial Group KSFG) company.

Tue, Dec 20, 2016 – On Tue, Jun 7, 2016, an Unlawful Detainer notice was served to a home owner in Royal Western Mobile Home Park located at 17705 South Western Avenue, Gardena, California 90248.

Royal Western Mobile Home Park is owned by a Kort & Scott company and managed by Sierra Corporate Management (SCM), also a Kort & Scott company.

On Fri, Aug 5, 2016, a court judgment was entered as final disposition for Royal Western GP Corp against the home owners. Not only did these home owners lose their mobile home, they have a financial judgment against them for $13,365.

This is another Kort & Scott eviction handled “judiciously” by John H. Pentecost, Esq. from the law firm of Hart | King, A Professional Corporation located at 4 Hutton Centre Drive, Suite 900, Santa Ana, California 92707.

- Case Number: 16F02484

- Filing Date: 06/03/2016

- Plaintiffs: Royal Western GP Corp dba Royal Western Mobilehome Park

- Plaintiff’s Attorney: Hart King – John H. Pentecost, Esq.

- Defendants: M****, Sergio and M****, Jennifer

- Defendant’s Attorney: None

06/07/2016 – Notice of Unlawful Detainer filing mailed to respective parties/counsel.

08/05/2016 – Judgment entered as a final disposition on 08/05/16, for (Royal Western GP Corp) dba (Royal Western Mobilehome Park), against (M****, Sergio), (M****, Jennifer), Past Due Rent + Daily Damages $11,565.17, Attorney Fees $1,550.00, Costs $250.00. Total $13,365.17, and for restitution of premises located at 17705 S. Western Avenue, Space No. 13 Gardena, CA 90248.

Evictimized – The Victims of Kort & Scott Financial Group

Here are 746 names, a small percentage of “human lives”, NOT chattel, that have been the victims of Kort & Scott Financial Group (KSFG) DBAs and Sierra Corporate Management (SCM) eviction proceedings in the California Civil Courts.

We’ve coined a new phrase for the process these individuals have endured for years, we call it being “Evictimized”, and refer to the human lives as “Evictims”, the victims of being victimized, and evicted from their mobile homes that many paid for in full – they rightfully owned their homes.

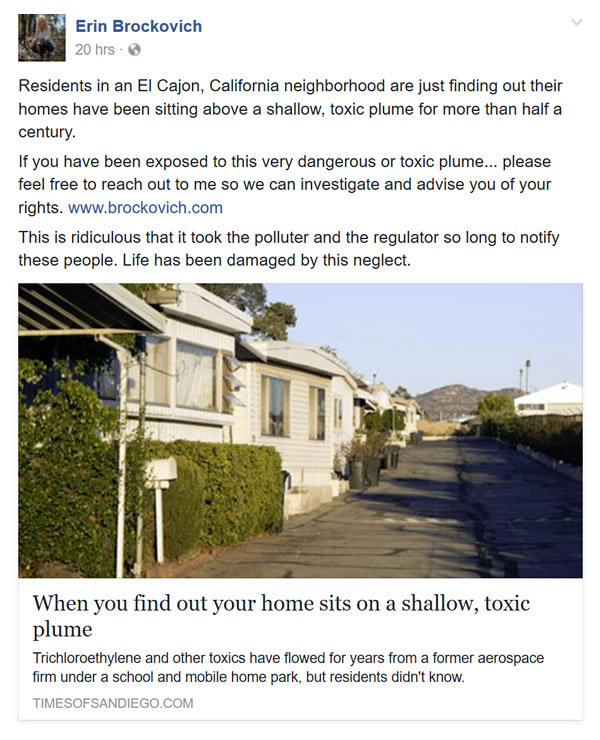

Starlight Mobile Home Park – El Cajon TCE Contamination Update

Mon, Dec 19, 2016 Updates – This email follows up on our recent correspondence regarding soil contamination in El Cajon. We have finished investigating the presence of TCE in the area and, unfortunately, will not be pursuing the matter further.

If you recall, a class action lawsuit was filed in 2015 by another local law firm for teachers and students of Magnolia Elementary School exposed to contaminated soil gas. The development of that lawsuit will likely inform whether or not a similar claim can be made on behalf of the residents in the area. Given the pending litigation, we have decided not to pursue additional legal action at this time.

Please be aware that if you decide to pursue individual claims concerning the contamination, those claims are governed by a statute of limitations. This means that a person like yourself has a certain length of time to bring a lawsuit against the party that you believe is responsible for the harm you suffered. Statutes of limitations range among the different states and the causes of action you might wish to pursue. The statute of limitations can be as short as one year from injury, or even shorter if the government is a responsible party. They are also often halted, or stayed, when a class action is pending. Consequently, it is important that you promptly seek other legal counsel if you wish to pursue a legal claim.

MHPHOA Note: Starlight Mobile Home Park is owned by a Kort & Scott Financial Group (KSFG) company and managed by Sierra Corporate Management (SCM), also a KSFG company.

View Media Coverage Timeline

Attorney Erin Brockovich to Investigate Toxic Plume in El Cajon

Thu, Nov 17, 2016 – Attorney Erin Brockovich will be investigating the allegations of a toxic plume of groundwater in an El Cajon neighborhood, according to a post on her Facebook page.

El Cajon residents say the plume is making the people living in the Starlight Mobile Home Park sick. The mobile home park sits above the plume.

‘We moved in November of last year, but we became so ill, summer gets worse.’ said Stephanie Jordan. ‘The hotter it gets, the more fumes you get.’ Until just a few months ago, Jordan had no idea she was living over a plume of toxic groundwater.

According to the San Diego Regional Water Quality Control Board, the groundwater has been polluted with cancer-causing chemicals for decades and can emit toxins into the air above via toxic vapors.

Two of the toxic chemicals present in the vapors are Trichloroethylene, also known as TCE, and Tetrachloroethlene, known as PCE.

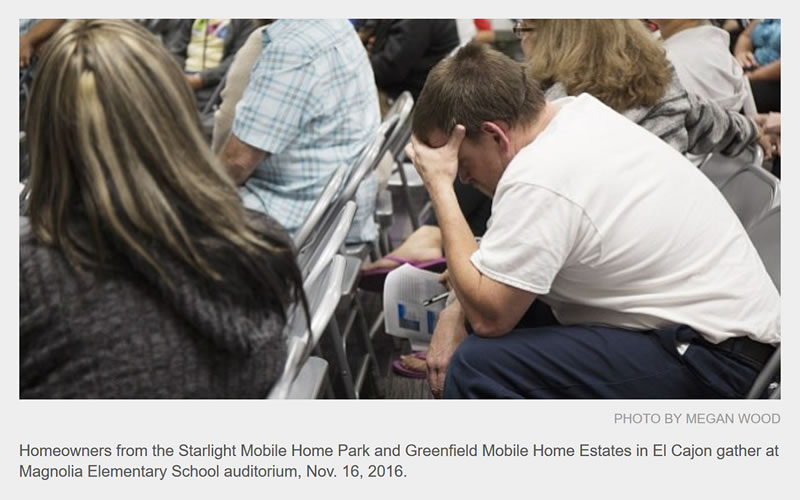

El Cajon Residents Pack Meeting on Toxic Plume

Thu, Nov 17, 2016 – State officials were just minutes into their presentation about an underground chemical plume in El Cajon when homeowners began raising questions: ‘Have you tested it?’ a voice came from the back. ‘How are we going to sell our homes?’ asked another.

Residents of the Starlight and Greenfield Mobile Homes Estates, along with other neighbors – some 60 in all – nearly filled a Magnolia Elementary School auditorium Wednesday evening.

Mobile Homes in Starlight Mobile Home Park to be Tested

Mon, Oct 31, 2016 – Residents in an El Cajon neighborhood are just finding out their homes have been sitting above a shallow, toxic plume for more than half a century.

Even after all this time, no one knows whether trichloroethylene and other chemical vapors have seeped up from tainted groundwater and entered homes through cracks in concrete. There has been no testing.

Now that is changing. In the last few days some residents of the Starlight Mobile Home Park on East Bradley Avenue have received visits from state officials offering to test the air in their homes. The state will also test the air outside.

For Anne Beams, a former Department of Defense teacher who has lived at Starlight since the 1980s, the developments come as a surprise.

‘No one at the park ever brought it to our attention,’ she said. Until this week, she was unaware of the plume. It’s a legacy of a 20th century aerospace manufacturing plant that once operated several hundred feet away.

‘Doesn’t it sound as though they were very slow in making those of us in Starlight aware of what could be happening to us all these years?’ she said of state authorities.

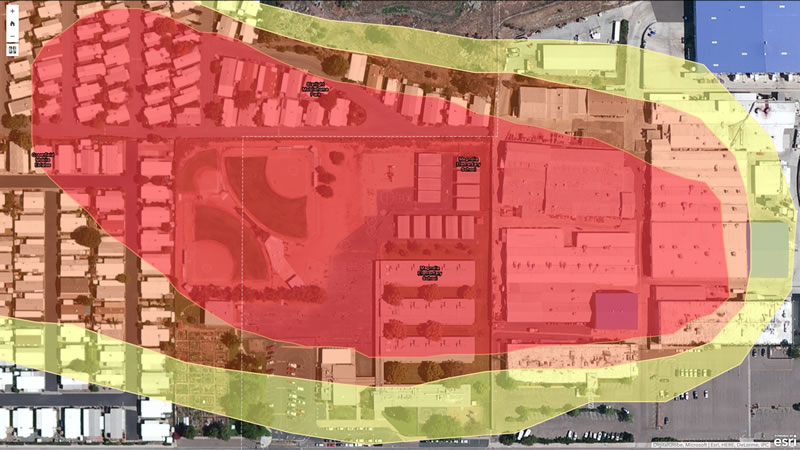

New Interactive Map of Toxic TCE Plume

Several residents asked a reporter about the location of the groundwater. But there is no easily accessible map online, let alone one that is interactive. inewsource made one, based on a map provided by the Regional Water Quality Control Board.

Toxic Plume in El Cajon Reaches Beneath Kort & Scott Mobile Homes

Sun, Oct 23, 2016 – On Thu, Oct 20, 2016, an article was published in inewsource regarding a toxic plume of TCE (Trichloroethylene) reaching beneath mobile homes. The article mentions a mobile home park in El Cajon, California but no specifics are provided.

The MHPHOA investigated further and it appears that two (2) Kort & Scott owned mobile home parks are affected; Starlight Mobile Home Park and Greenfield Mobile Home Estates. Both mobile home parks have mobile homes that are within the 1,000 μg/liter contour. No action and little testing have taken place there – until now. Here are some key snippets from the article…

The California Department of Toxic Substances Control issued a notification Thursday, October 6, 2016 after a contractor tested soil there and found TCE levels that left no doubt further testing should be done.

We collected data near the mobile homes along the property boundary and concentrations were detected at 5 feet below ground surface that are at level that may result in what we consider a significant risk to residents,” said Shahir Haddad, a supervising engineer for DTSC.

Several people at the mobile park said they’ve not been told that the plume runs under their homes. Most did not want to give their names.

Residents at the mobile park will be told of the testing results. The county water board is arranging a location and time, the agency’s Sean McClain said in an email.

SCM Long-Term Lease Agreements – Components and Commentary

Sun, Dec 18, 2016 – An online contact request was submitted to the MHPHOA for an all inclusive post regarding the Sierra Corporate Management long-term lease agreements. Here is a repository of links to the data we have available which make up the various components of the long-term lease agreements traps being offered to residents by the Kort & Scott companies (DBAs) that own the mobile home parks.

1. Sierra Corporate Management – Long-Term Lease Agreements

Be very careful when “considering” signing any long-term lease with Sierra Corporate Management (SCM). The standard 15, 20 or 25 year SCM long-term lease agreement may contain a sentence that locks you into a minimum 8.0%, 7.0% or 6.0% yearly space rent increase whether the cost of living (CPI) justifies it or not.

The first paragraph of the Sierra Corporate Management Lease Agreement may read something like this, it is in 12PT ALL CAPS, and should be FAIR WARNING that you are about to give up your homeowners rights if you sign the lease.

This agreement will be exempt from any ordinance, rule, regulation or initiative measure adopted by any Governmental entity which establishes a maximum amount that a landlord may charge a tenant for rent.

2. Sierra Corporate Management – Long-Term Lease Agreement Sample

3. SCM Lease Incentives – $1,000.00 Paid to You Directly in a Check!

The question of “How much is a lease worth to KSFG/SCM?” has arisen many times. We've crunched the raw data and have added a new column to our SCM Space Rent Calculator showing your "Lease Value" or what you will pay for your Space Rent for the duration of your lease. The Lease Value also gives us an all-in starting point for the total value of the Lease Receivables.

4. Sierra Corporate Management – Unconscionable MHP Leases

DO NOT SIGN a Kort & Scott Financial Group (KSFG) dba Sierra Corporate Management (SCM) Lease Agreement until you have sought professional and/or legal advice. The MHPHOA believe the long-term lease agreements being offered by Kort & Scott Financial Group (KSFG) dba Sierra Corporate Management (SCM) are Unconscionable Contracts aka Unlawful Contracts. These leases are overly harsh, unduly oppressive, unreasonably favorable and so one-sided as to shock the public conscience.

5. Sierra Corporate Management – Forbearance Agreements

DO NOT SIGN a Kort & Scott Financial Group (KSFG) dba Sierra Corporate Management (SCM) Forbearance Agreement until you have sought professional and/or legal advice. Signing an SCM Forbearance Agreement waives your homeowner’s rights and releases KSFG/SCM from any and all past, present, and/or future liabilities, claims, disputes, controversies, suits, actions, causes of action, loss, debt, damages or injuries (collectively referred to as “claims”), matured or contingent, liquidated or unliquidated, known and unknown, suspected or unsuspected, which TENANT may have against PARK.

6. SCM Space Rent Specials and Addendum Clauses

Did you purchase a park owned or affiliate owned mobile home in a KSFG/SCM mobile home park? We're you offered a space rent special if you signed a long-term lease agreement? Does your long-term lease agreement contain a lease term section referencing a separately attached Lease Addendum?

Sat, Dec 17, 2016 – Do you live in a mobile home park owned by Kort & Scott Financial Group (KSFG) and managed by Sierra Corporate Management (SCM)? Are you confused about meeting park management demands? Have you been given official looking notices and papers that aren't clear to you? You DO NOT have to blindly do everything that some park managers and park owners tell you to do. We provide free counseling and advice, we can connect you as needed, with the people that can help you legally and financially.

The Victims of Kort & Scott Financial Group

Here are 746 names, a small percentage of "human lives", NOT chattel, that have been the victims of Kort & Scott Financial Group (KSFG) DBAs and Sierra Corporate Management (SCM) eviction proceedings in the California Civil Courts.

We've coined a new phrase for the process these individuals have endured for years, we call it being "Evictimized", and refer to the human lives as "Evictims", the victims of being victimized, and evicted from their mobile homes that many paid for in full – they rightfully owned their homes.

Fri, Dec 16, 2016 – DO NOT SIGN a Kort & Scott Financial Group (KSFG) dba Sierra Corporate Management (SCM) Forbearance Agreement until you have sought professional and/or legal advice. Signing an SCM Forbearance Agreement waives your homeowner’s rights and releases KSFG/SCM from any and all past, present, and/or future liabilities, claims, disputes, controversies, suits, actions, causes of action, loss, debt, damages or injuries (collectively referred to as “claims”), matured or contingent, liquidated or unliquidated, known and unknown, suspected or unsuspected, which TENANT may have against PARK.

Thu, Dec 15, 2016 – According to online documents, Kort & Scott purchased Country Club Village located at 2060 North Center Street, Mesa, Arizona 85201 in 1995 for $7.75MM. It was refinanced in Dec 2015 for $3.1MM.

In Jan 2016, Country Club Village was listed for sale on LoopNet for $9.5MM (Leasehold Only) with a Cap Rate of 9.93% and an incubation upside of 64% occupancy in a 90%+ market. In Mar 2016, the listing was removed from LoopNet. In Oct 2016 and as of Thu, Dec 15, 2016, the listing is active again. See the below timeline of sales listings posted by Martinez and Associates.

Country Club Village For Sale

- Fri, Oct 14, 2016 – Martinez and Associates Listing – Price: $9,500,000

- Mon, Oct 10, 2016 – LoopNet Listing Offline

- Mon, Jun 6, 2016 – Country Club Village for sale (Leasehold Only) on LoopNet for Price Not Disclosed ($6,000,000 to $10,000,000) with a Cap Rate of 9.93%. This park is located in the high demand Phoenix rental market.

- Mon, Mar 7, 2016 – LoopNet Listing Offline

- Fri, Jan 22, 2016 – Country Club Village for sale (Leasehold Only) on LoopNet for $9,500,000 with a Cap Rate of 9.93%. Incubation Upside: 64% Occupancy in a 90%+ Market.

History: Mesa, Arizona – Country Club Village – Project 97

Thu, Dec 15, 2016 – According to online documents, KSFG purchased Country Club Village in Mesa, Arizona in 1995. Within two (2) years, the park attained the dubious honor of having more police related calls for service than any other address in the city. The city stepped in and took control of things and restored some order in the park. They even setup a satellite station within the park due to the severity of the situation.

In recent years (1997-1998), a large mobile home park known as Country Club Village, located in Mesa, Arizona, has attained the dubious honor of having more police related calls for service than any other address in the city. The Mesa Police Department's Falcon District Community Action Team collaborated with city entities and community members in an operation known as Project 97. The project's goal was to reduce the amount of police related calls for service and improve the quality of life in the community.

Project 97 was created in an attempt to drastically reduce crime and increase the quality of life within the 496 unit mobile home park which is home to 1600-1800 residents. A history of calls for service beginning January 1, 1998 through June 30, 1998 revealed a diverse array of crime related calls. Specifically, a majority of the calls were residential thefts, subjects disturbing, criminal damage, graffiti, and drug related calls. A majority of the less serious calls for service were 911 hangups, illegal parking, dogs at large, and various city code violations. An initial survey was given to all residents inquiring about the perception of crime and living conditions. The survey revealed that community members had become disillusioned and felt paralyzed by the scope of their situation.

Mobile Home Sales – Monarch Home Sales

Wed, Dec 14, 2016 – One question that has been continually asked by residents is how can the Real Estate Agents sell mobile homes in Kort & Scott parks knowing what is happening and what the outcome may be? If they were Realtors, they may be in violation of their licensing requirements and Code of Ethics which states this…

REALTORS® having direct personal knowledge of conduct that may violate the Code of Ethics involving misappropriation of client or customer funds or property, willful discrimination, or fraud resulting in substantial economic harm, bring such matters to the attention of the appropriate Board or Association of REALTORS®.

But, these are not Realtors that we are discussing, these are individuals who have an HCD Occupational License which allows them to legally sell mobile homes in the State of California. The Occupational Licensing Program is administered exclusively by the California Department of Housing and Community Development.

The MHPHOA believe that the high volume retailers in Kort & Scott owned mobile home parks have “direct personal knowledge” of the park owner’s predatory business practices. One such retailer is Monarch Home Sales located at 8907 Warner Avenue, Suite 151, Huntington Beach, California 92647-8303, 714-916-0310.

Based on our research of publicly available information, Monarch Home Sales have been responsible for a large number of mobile home sales in a portion of Kort & Scott mobile home parks since Jan 2013. These particular mobile home parks owned by Kort & Scott are experiencing an alarmingly high turnover rate and Monarch Home Sales is where it begins.

Tue, Dec 13, 2016 Updates – All linked legal references have been updated to the new California Legislative Information website at https://leginfo.legislature.ca.gov/. This new website has been updated to include legislative publications starting with the 2017 session and forward.

Legal Definition of Breach: An act of breaking or failing to observe a law, agreement, or code of conduct. Synonyms include but are not limited to; Violation, Infringement, Infraction and/or Neglect.

We have studied ten (10) past and current lawsuits filed against multiple Kort & Scott companies operating mobile home parks in California. We have extracted most of the alleged complaints and breaches, including most of the Civil Codes referenced in the lawsuits. We have found the majority of these Civil Codes repeated in the various lawsuits, they are common complaints by the mobile home owners/residents in KSFG owned mobile home parks.

Our goal is to build a “Copy Ctrl+C and Paste Ctrl+V” repository of all the Civil Codes that the KSFG DBAs are breaching. You can use this information to your advantage when working with legal counsel and/or other concerned entities. We will continually update this section as new information becomes available.

Mon, Dec 12, 2016 – From the 2017 California Mobilehome Residency Law Frequently Asked Questions: Rents, Fees and Taxes, 6. Security Deposit

Resident Question:

Can the park charge first and last months’ rent plus a 2-month security deposit?MRL Answer:

Normally, when a mobilehome owner is accepted for residency in a mobilehome park and signs a rental agreement, charging first month’s rent and a 2-month security deposit are permitted. (Civil Code §798.39) After one full year of satisfactory residency (meaning all rent and fees have been paid during that time), the resident is entitled to request a refund of the 2-month security deposit, or may request a refund at the time he or she vacates the park and sells the home. (Civil Code §798.39(b))

2017 California MRL FAQs

Submit your request for a security deposit refund in writing to Sierra Corporate Management today! The MRL specifically states that SCM must refund your deposit after one full year of satisfactory residency. Do not wait until you vacate the park and/or sell your mobile home.

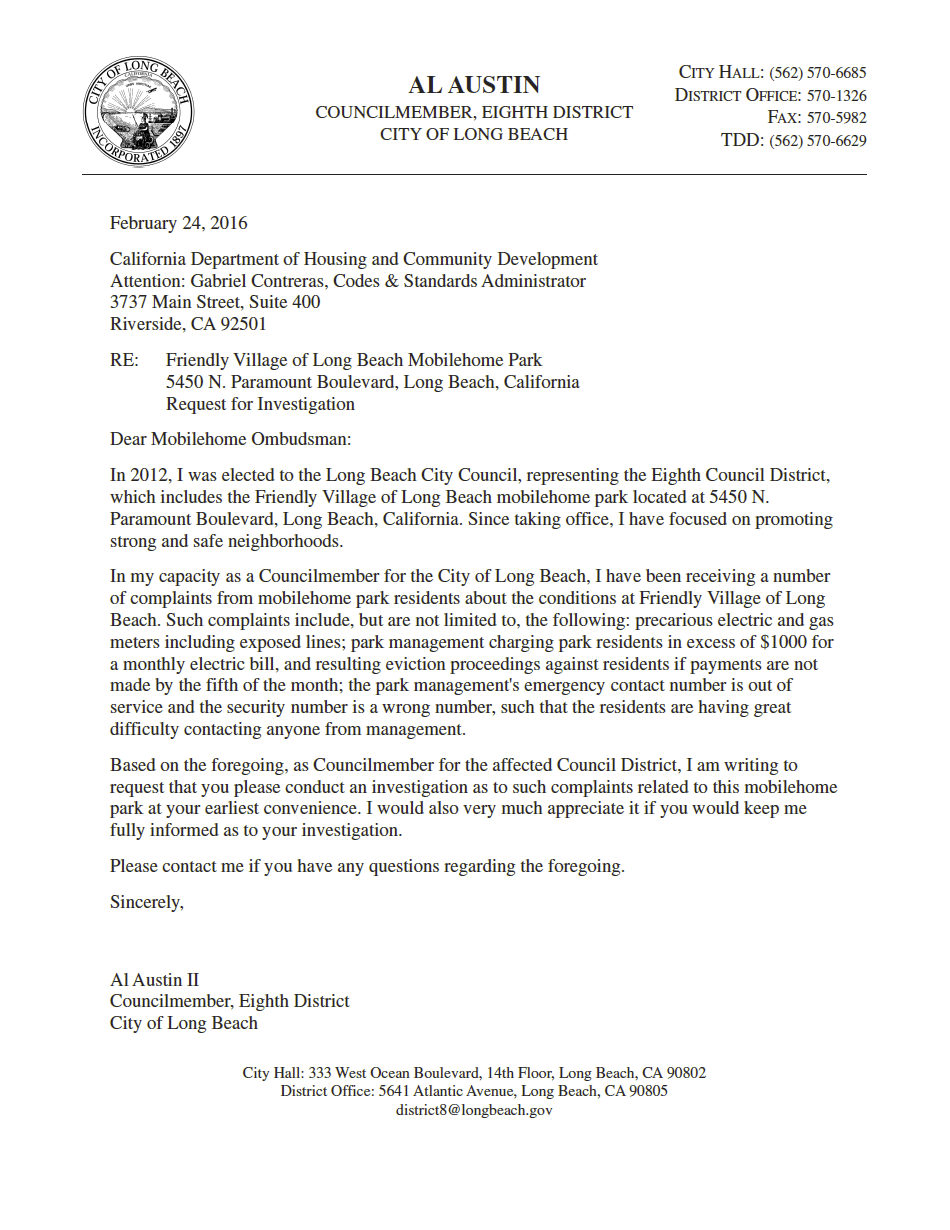

Friendly Village Mobile Home Park – Testing for Methane Levels

Sun, Dec 11, 2016 Updates – In a letter dated Fri, Nov 18, 2016 from Rich Pinel, President of Sierra Corporate Management, residents of Friendly Village Mobile Home Park in Long Beach, California were informed that a Pilot Test Program will start in Jan 2017 that is designed to seek and measure any levels of Methane that may exist below the surface of the park.

It has been sixteen (16) months since the current group of HCD Complaints started in Aug 2015. These Complaints eventually morphed into Violations and some were to be corrected within thirty (30) days – that has not happened. A small sampling of HCD Public Information Requests for this park reveal a history of Complaints that appear to still exist as of this date. That history also shows these Complaints being closed by certain HCD Inspectors with findings such as…

CPT Assignment: MP15-1044

Allegation: Water line exposed to sun, sewage lines broken.

Findings: Water lines and sewage are in compliance.

OK to Close file.

As of today Sun, Dec 11, 2016, we are informed that these major violations exist in some permutation. There have been ongoing emergency repairs with the sewage system. There have been resident reports of sewage line end caps blowing off and raw sewage being spewed onto the surrounding areas. In one recent event, residents had to be evacuated due to sewage backing up into the home, see the FOX11 News video below.

Why was the above HCD Complaint dated Oct 13, 2015 marked as “OK to Close file”?

Friendly Village Mobile Home Park – Legal Battle Involving Methane Leaks

Wed, Nov 30, 2016 – Brian Kabateck of Kabateck Brown Kellner LLP, talked with FOX11 about a legal battle involving methane leaks at a mobile home park built on a landfill.

The “mobile home park built on a landfill” is Friendly Village Mobile Home Park in Long Beach, California. The MHPHOA reported on Sun, Apr 3, 2016 about the HCD violating 174 of the 182 lots in the park, see story below. Since then, there have been continual delays by both the HCD and Kort & Scott Financial Group aka Sierra Corporate Management.

The residents of Friendly Village Mobile Home Park recently filed a Temporary Restraining Order (TRO) against Sierra Corporate Management regarding a pending rent increase.

Mobile Home Park Rent Strike

What the residents of Friendly Village Mobile Home Park might consider is organizing a Rent Strike and not paying any space rent to Sierra Corporate Management. Space rents would be deposited in Escrow, on time, each month, until such time that ALL mobile home park violations have been abated.

No more delays, extensions, and/or passed deadlines via HCD, this has been ongoing far too long, since at least Aug 2015. No more opportunistic evictions by Sierra Corporate Management. No more selling mobile homes to unsuspecting buyers. And, no more rent increases while the quality of life continues to decrease.

HCD Complaints Timeline: MP15-1044, Opened 08-28-15, Closed 10-13-15 / MP15-1163, Opened 09-21-15, Closed 10-13-15 / MP15-1435, Opened 11-25-15, Closed 04-15-16 / MP16-0041, Opened 01-11-16, Closed 08-22-16 / MP16-0061, Opened 01-19-16, Closed 01-22-16 / MP16-0063, Opened 01-14-16, Closed 01-27-16 / MP16-0105, Opened 01-26-16, Closed 02-11-16 / MP16-0000, Opened 08-02-16

Friendly Village Mobile Home Park – HCD Violates 174 of 182 Lots

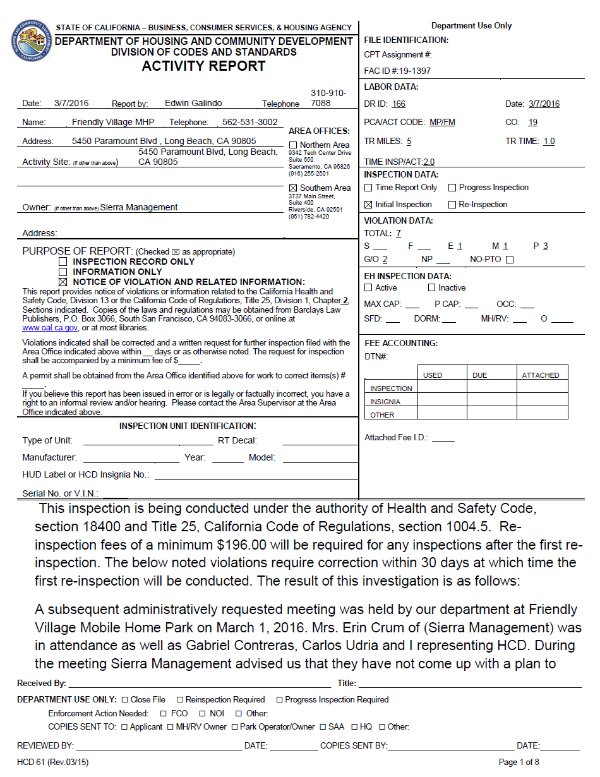

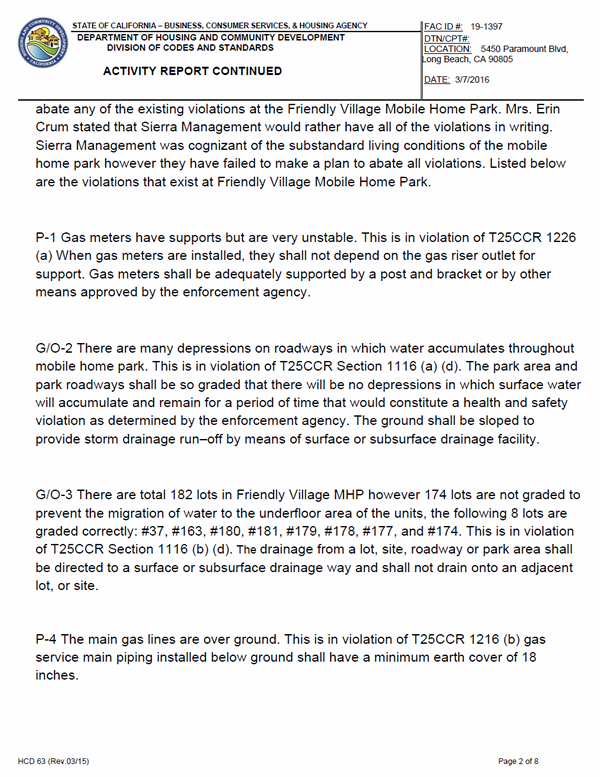

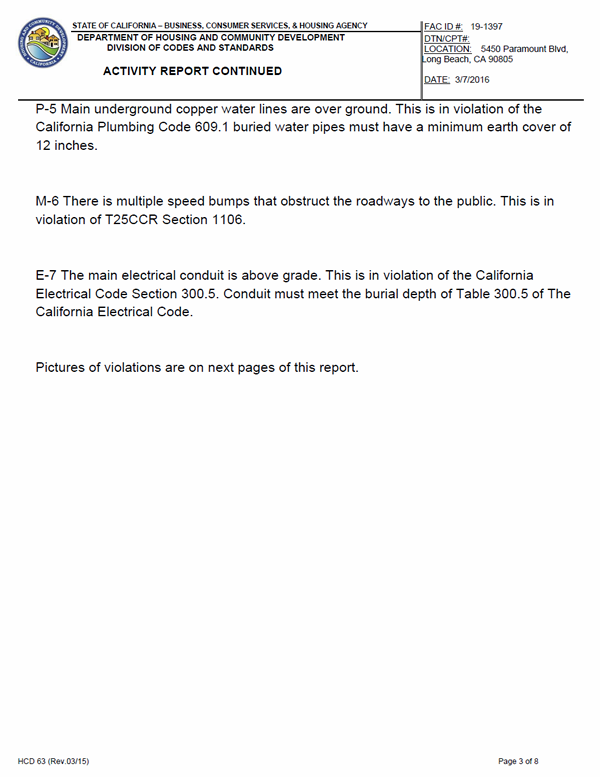

Sun, Apr 3, 2016 – This inspection is being conducted under the authority of Health and Safety Code, section 18400 and Title 25, California Code of Regulations, section 1004.5. Re-inspection fees of a minimum $196.00 will be required for any inspections after the first re-inspection. The below noted violations require correction within 30 days at which time the first re-inspection will be conducted. The result of this investigation is as follows:

A subsequent administratively requested meeting was held by our department at Friendly Village Mobile Home Park on March 1, 2016. Mrs. Erin Crum of (Sierra Management) was in attendance as well as Gabriel Contreras, Carlos Udria and I representing HCD. During the meeting Sierra Management advised us that they have not come up with a plan to abate any of the existing violations at the Friendly Village Mobile Home Park. Mrs. Erin Crum stated that Sierra Management would rather have all of the violations in writing. Sierra Management was cognizant of the substandard living conditions of the mobile home park however they have failed to make a plan to abate all violations.

Friendly Village Mobile Home Park Image Library

5450 North Paramount Boulevard, Long Beach, California 90805

Department of Housing and Community Development (HCD) Activity Report

File Type: PDF, Pages: 8, File Size: 451KB

Letter from City Councilmember

File Type: PDF, Pages: 1, File Size: 25KB

Letter from City of Long Beach

File Type: PDF, Pages: 1, File Size: 27KB

Sat, Dec 10, 2016 – On Tue, Dec 13, 2016 at 10:00 AM, in the Park Office of Lincoln Center Mobile Home Park in Cypress, California (owned by a Kort & Scott company), a 2006 Fleetwood Spring Hill occupying Space 93 will be auctioned off to the highest bidder.

It is a 4 Bedroom, 2 Bath mobile home with 1,344 square feet (24x56). The total amount due on this property, including estimated costs, expenses and advances as of the date of the public sale, is $13,035.42.

Opening bid normally begins at $500 – and stops there. We are informed there are few people in attendance with what appears to be a Kort & Scott (dba Sierra Corporate Management) affiliate winning the bid at $500.

The NOTICE OF PUBLIC SALE contains a statement regarding removal of the mobile home that reads…

Said sale is to be held without covenant or warranty as to possession, financing, encumbrances, or otherwise on an “as is”, “where is” basis. Upon sale, the mobilehome must be removed from the Premises.

We are informed and have a documented timeline of this statement not being adhered to by a Kort & Scott affiliate after winning the bid. Many of these mobile homes that are auctioned off contain this statement and the MHPHOA believe this prevents all but 1 or 2 potential buyers from attending the auctions.

Public Sale: 1969 Lancer Mobile Home at $19,907

Another mobile home occupying Space 76 is being auctioned off in Lincoln Center Mobile Home Park on Mon, Dec 12, 2016 at 10:00 AM. It is a 1969 Lancer and has an encumbrance of $19,907.22. It contains the statement that the mobile home must be removed from the premises upon sale.

Who would purchase a 1969 mobile home with a $20,000 lien that requires another $5,000 or more for breakdown, preparation, transportation, and then setup costs elsewhere? Will these mobile homes in Spaces 76 and 93 be removed from the premises upon sale? To be continued…

Space 93 History: Mobile Home for Sale at $69,900

On Mon, Oct, 21, 2013, a 2006 Fleetwood occupying Space 93 sold for $69,900. Online records show the listing agent as David Franzoni from Family Homes. The serial numbers advertised were CAFL608A70111SH12 and CAFL608B70111SH12, typical of a double-wide mobile home, note the A and B differences.

The buyers signed a 25-year long-term lease agreement with an Addendum space rent special of $1,395 for the first year. These types of Addendum space rent specials are typically available for affiliate owned aka park owned mobile homes – Buy Here. Pay Here. Stay Here.

TWENTY-FIVE (25) YEAR OPTION

(3) The beginning monthly rent shall be $1,500.00 which shall remain in effect until the first anniversary date (or rent adjustment date) which is July 1 of each calendar year. Each anniversary date, then current monthly rent shall be adjusted based upon 100% of the annual increase in the Consumer Price Index (CPI) for the County area (1982-1984 = 100), utilizing the "All Urban Consumers" index as of the most recent month available at the time of the of giving notice of the increase to Tenant. In no event shall the annual increase in the rent be less than six percent per month of the then last charged monthly rent. In the event that the CPI index is discontinued or revised, another governmental index then in existence shall be selected by Owner and used to obtain substantially the same result as if the CPI index had not been discontinued or revised. *Addendum: Space rent for the first year shall be $1,395.00 (10/11/13-9/30/14). All subsequent annual rent increases shall remain as indicated herein. Addendum rent is only valid for original tenant and is not transferrable/assignable to assignees/future residents.

History: 3/60 Notification Reviewed by Hart | King, A Professional Corporation

On Tue, Jul 12, 2016, Mark Graham, Authorized Agent for Lincoln Center Mobile Home Park served the mobile home owners occupying Space 93 a “THREE (3) DAY NOTICE TO PAY RENT OR QUIT AND SIXTY (60) DAY NOTICE TO TERMINATE POSSESSION”.

Once you have been properly served with a 3/60 by the Kort & Scott company that owns your mobile home park, any promotional forbearance rent credits are stripped and added to the monthly base rent.

These home owners started out with a space rent special of $1,395 in Oct 2013. As of Jul 2016, documentation shows their space rent at $1,580 and due to the 3/60, it is now $1,685, that’s a 21% increase in less than 3 years.

The total amount of rent due and owing is $1,580.40. This total amount of rent due and owing includes a credit for partial payment and/or a Promotional / Forbearance Rent Credit of $105.00 for the month of N/A, 2016, leaving a balance of $1,580.40 for such month. This amount is included in the total rent due and owing. The monthly rental rate for the Premises is $1,685.40 per month.

History: Mobile Home for Sale at $65,000, Space Rent $1,750

On Mon, Aug 1, 2016, a 2006 Fleetwood occupying Space 93 listed for sale at $65,000 with a Space Rent of $1,750. Online records show the listing agent as Andrew Kull from Exit Alliance Realty. The serial numbers advertised were CAFL608A70111SH12 and CAFL608B70111SH12.

History: Unlawful Detainer Lawsuit

On Mon, Nov 14, 2016, a Writ of Possession was Wholly Satisfied for Space 93 – the home owners were evicted. These home owners appear to have lasted thirty-three (33) months in their mobile home before falling prey to the Kort & Scott predatory business model.

Fri, Dec 9, 2016 Updates – When a mobile home is abandoned, Kort & Scott Financial Group (KSFG) dba Sierra Corporate Management (SCM), are required by California Civil Code Section 798.56a and California Commercial Code Section 7210, to follow certain procedures regarding the possession and sale of the abandoned mobile home. These mobile home sales are performed via a NOTICE OF PUBLIC SALE in the local newspapers, see actual recent examples in the article.

- Auction Location: Mobile Home Park Management Office

- 09:59 AM – Persons Present: Sierra Corporate Management (SCM) Park Manager (1), SCM Representative (1), Possible Unnamed Participant(s).

- 10:00 AM – Five (5) minute introduction which includes public auction information and instructions.

- 10:05 AM – SCM Park Manager opens bidding at $500. SCM Representative raises hand.

- 10:05 AM – No other bidders. SCM Representative wins bid at $500.

Knolls Lodge Mobile Home Park, Space 42 $19,135

Auction Date: Wed, Aug 24, 2016 at 10:00 AM – NOTICE OF PUBLIC SALE

NOTICE IS HEREBY GIVEN pursuant to California Civil Code Section 798.56a and California Commercial Code Section 7210 that the following described property will be sold by Knolls Lodge (Warehouse) at public auction to the highest bidder for cash, in lawful money of the United States, or a cashier’s check payable to Knolls Lodge, payable at time of sale, on Wednesday, August 24, 2016, at 10:00 AM at the following location: 23701 S. Western Avenue, Park Office, Torrance, CA 90501.

Said sale is to be held without covenant or warranty as to possession, financing, encumbrances, or otherwise on an “as is”, “where is” basis. Upon sale, the mobilehome must be removed from the Premises.

The property which will be sold is described as follows: MANUFACTURER: Unknown TRADENAME: Homette YEAR: 1973 H.C.D. DECAL NO.: LBJ1292 SERIAL NO.: G0372S847. The current location of the subject property is: 23701 S. Western Avenue, Space 42, Torrance, CA 90501.

The public auction will be made to satisfy the lien for storage of the above-described property that was deposited by Eugene Nam Jo aka Eugene Jo, Jingyu Jin, Samuel Lee, Southwest Mobile Homes with Knolls Lodge.

The total amount due on this property, including estimated costs, expenses and advances as of the date of the public sale, is $19,134.56. The auction will be made for the purpose of satisfying the lien on the property, together with the cost of the sale.

Park Manager Told to Push Sale of Park Owned Mobile Homes

Wed, Dec 7, 2016 – On Thu, Dec 1, 2016, documents were made available online regarding a Motion for Preliminary Injunction against Friendly Village Mobile Associates LP, Friendly Village MHP Associates LP and Friendly Village GP LLC, all Kort & Scott DBAs for Friendly Village Mobile Home Park in Long Beach, California which is managed by Sierra Corporate Management.

Within the 8 page Final Order denying the Motion for Preliminary Injunction, there is a Discussion Timeline regarding the Background of the case. On page 6 is a one paragraph summary of the previous [Park Manager]’s Declaration. It reads as follows and has been edited [Park Manager] to remove personally identifiable information.

Further, according to [Park Manager] (who served as the Park manager from March 1, 2014 until September 2015), says that after a resident was evicted, she was instructed to get the Park-owned mobile home unit ready for sale and to list it at a price below the rate of other mobile homes in the Park. She says she did as she was instructed and would have the mobile home units from evicted residents listed for sale at a price of approximately 2/3 of other units listed in the Park at the time. [Park Manager] also says that she was told to push the sale of the Park-owned units over those of other residents when prospective buyers came to the Park. Also, [Park Manager] claims the paperwork to and from Sierra for prospective buyers who were interested in Park-owned units took place very quick whereas paperwork to and from Sierra for prospective buyers interested in resident-owned units took place very slowly.

Acosta v. City of Long Beach – Department 310 – Law and Motion Rulings

This story to be continued.

Friendly Village Mobile Home Park

5450 North Paramount Boulevard, Long Beach, California 90805

- 2015-08-15 – Civil Lawsuit Filed by Residents

- Case Number: BC591412

- Plaintiffs 1-XXX vs. Friendly Village of Long Beach

- Status: In Progress

Complaint Summary: Failure to Maintain Mobilehome Park, Breach of Contract, Negligence, Negligent Infliction of Emotional Distress, Continuing Trespass, Public Nuisance, Private Nuisance, Inverse Condemnation, Unfair Business Practices.

Civil Lawsuits Against Kort & Scott Companies

The MHPHOA continue to expand the repository for litigation proceedings against Kort & Scott companies and its mobile home park management company Sierra Corporate Management (SCM).

- 2016-10-05 – Continental Manufactured Home Community

Status: In Progress

- 2016-03-25 – Royal Oak Manufactured Home Community

Status: The People of the State of California Won a Final Judgment on 2016-08-02, Injunction Against Davis Group LP and Western Ventures LP

- 2015-08-15 – Friendly Village Mobile Home Park

Status: In Progress

- 2015-04-01 – Emerald Meadows Mobile Home Park (2 of 2)

Status: Set for Trial 2017-10-10, Mandatory Settlement Conference 2017-08-31

- 2014-05-29 – Bayshore Villa Mobile Home Park

Status: A San Mateo Superior Court Judge issued a Preliminary Injunction in Cruz vs. Sierra Corporate Management, Hearing Motion for Class Certification Held on 2016-10-13, Due 2016-12-12

- 2012-01-13 – Royal Western Mobile Home Park (2 of 2)

Status: Plaintiffs Won Civil Lawsuit on 2014-08-28, Damages Awarded: $1,700,000+

- 2009-08-26 – Hollydale Mobile Home Park

Status: Plaintiffs Won Civil Lawsuit (Researching), Damages Awarded: (Researching)

- 2009-03-13 – Greenfield Mobile Home Estates

Status: Defendants Won Civil Lawsuit on 2010-03-02, Damages Awarded: $370,000+

- 2006-09-22 – Emerald Meadows Mobile Home Park (1 of 2)

Status: Plaintiffs Won Civil Lawsuit on 2008-06-05, Damages Awarded: $3,800,000+

- 2004-05-28 – Royal Western Mobile Home Park (1 of 2)

Status: Plaintiffs Won Civil Lawsuit on 2006-12-06, Damages Awarded: $1,300,000+

Kort & Scott Companies – Perpetual Breach of §17200

Legal Definition of Breach: An act of breaking or failing to observe a law, agreement, or code of conduct. Synonyms: Violation, Infringement, Infraction, Neglect

We have studied ten (10) past and current lawsuits filed against multiple Kort & Scott companies operating mobile home parks in California. We have extracted most of the alleged complaints and breaches, including most of the Civil Codes referenced in the lawsuits. We have found the majority of these Civil Codes repeated in the various lawsuits, they are common complaints by the mobile home owners/residents in KSFG owned mobile home parks.

Our goal is to build a “Copy Ctrl+C and Paste Ctrl+V” repository of all the Civil Codes that the KSFG DBAs are breaching. You can use this information to your advantage when working with legal counsel and/or other concerned entities. We will continually update this section as new information becomes available.

Park Manager: Company Wanted to Teach Me How to do Illegal Sales

Mon, Oct 24, 2016 – Sierra Corporate Management Onsite Community Manager Review of Lamplighter Sacramento Mobile Home Park: 2016 Mar – I am a calm and a peaceful person. I love all my jobs and give 100%. This company wanted to teach me how to do illegal sales. I told them that let's fix the homes and then sell them but this statement offended them and I ended up being the bad employee. Legally we are supposed to have a Property Manager, Assistant Manager and a full time Maintenance person. Instead, I was the only Property Manager there and we had a part time porter (not maintenance). As me being a great employee, I continued working there and doing 3 person's jobs all by myself. I know I was learning and, learning is the key to success. I will find a better job and be successful as I am a hard worker and a leader.

Onsite Community Manager (Former Employee)

Tue, Dec 6, 2016 – DO NOT SIGN a Kort & Scott Financial Group (KSFG) dba Sierra Corporate Management (SCM) Lease Agreement until you have sought professional and/or legal advice. The MHPHOA believe the long-term lease agreements being offered by Kort & Scott Financial Group (KSFG) dba Sierra Corporate Management (SCM) are Unconscionable Contracts aka Unlawful Contracts. These leases are overly harsh, unduly oppressive, unreasonably favorable and so one-sided as to shock the public conscience.

The MHPHOA have not been able to locate an example of a Residential Lease Agreement that compares to the KSFG/SCM Mobile Home Park Lease Agreement. In fact, all of our research regarding the KSFG/SCM leases leads to commercial grade contracts referred to as NN (Double Net) or NNN (Triple Net) Leases. The NNN lease, often just called the “Triple Net Lease” is a popular lease structure in commercial real estate.

§798.19 No Waiver of Chapter 2.5 Rights

No rental agreement for a mobilehome shall contain a provision by which the homeowner waives his or her rights under the provisions of Articles 1 to 8, inclusive, of this chapter. Any such waiver shall be deemed contrary to public policy and void.

2016 California MRL

Mon, Dec 5, 2016 – On Wed, Jul 6, 2016, a San Diego civil jury awarded 10 households of the Terrace View Mobile Home Park $58,389,000 in compensatory and punitive damages against the Park owners, Tom Tatum & Jeff Kaplan.

The case involved charging unreasonable rents and other illegal practices causing residents to lose their homes.

At the time of trial, 100 of the 200 spaces at the Terrace View Mobile Home Park were empty or abandoned due to the park owners' practices.

This is the first phase of 49 homes that are part of the lawsuit. The case was tried by James Allen and Jessica Taylor of San Diego based firm Allen, Semelsberger & Kaelin.

Allen Semelsberger & Kaelin, LLP

San Diego Mobile Home Lawyers

600 B Street, Suite 2400, San Diego, California 92101

619-544-0123, 800-895-5053, https://www.asklawgroup.com/

Terrace View Mobile Home Estates

13162 Highway 8 Business, El Cajon, California 92021

- Filing Date: 2013-07-12 – Class Action Lawsuit Filed by Residents

- Case Title: Aranda vs. Terrace View Partners LP

- San Diego Superior Court Case Number: 37-2013-00057526-CU-PO-CTL

- Status Phase I: 2016-07-06 – Plaintiffs Won Class Action Lawsuit

- Damages Awarded: $58,389,000

Complaint Summary

- Nuisance

- Breach of Contract

- Illegal Change of Use

- Negligence

- Intentional Interference with Property Rights

- Breach of Covenant of Good Faith and Fair Dealing

- Breach of Statutes

- Breach of Unfair Competition Law

- Breach of Warranty of Habitability

- Breach of Covenant of Quiet Enjoyment

- Elder Financial Abuse

Eleventh Cause of Action for Elder Financial Abuse by all Senior Citizen Plaintiffs

120. Defendants took, appropriated, obtained and/or retained or assisted in taking, appropriating, obtaining and/or retaining Senior Citizens' mobilehomes by refusing to approve prospective purchasers of Plaintiffs' mobilehomes, and by raising rents to unreasonably high levels. As a result Senior Citizen Plaintiffs were harmed and have been deprived of their right to sell their homes in the Park and have had to either walk away from their home or to sell them to Defendants for almost nothing.

121. Defendants' actions and/or conduct alleged herein was done for a wrongful use, with intent to defraud and/or by undue influence by preventing Plaintiffs from selling their mobilehomes in place in the Park, or keeping them there at reasonable rent levels.

122. Defendants knew or should have known that their actions and/or conduct were likely to be harmful to Plaintiffs and would prevent Plaintiffs from being able to sell their mobilehomes in place in the Park and would result in Defendants taking the financial investments Plaintiffs have in their mobilehomes in violation of Elder Abuse and Dependent Adult Civil Protection Act. Defendants' actions and/or conduct was a substantial factor in causing Plaintiffs' harm. Plaintiffs seek all damages allowed under the Elder Abuse and Dependent Adult Civil Protection Act and all other remedies otherwise provided by law (including, but not limited to, rescission) to compensate them for the harm proximately caused by Defendants.

123. Defendants were aware of Plaintiffs' right to sell their homes in place and the effect raising rents to unreasonably high levels would have on Plaintiffs' ability to sell their mobilehomes. Defendants deliberately interfered with the sale of Plaintiffs' homes by the actions alleged herein. Defendants subjected them to cruel and unjust hardship in conscious disregard of Plaintiffs' rights. Defendants consciously inflicted economic and personal hardship upon Plaintiffs by interfering with the sale of their mobilehomes which was despicable and Defendants' conduct constitutes oppression, fraud, and/or malice. Defendants' conduct warrants an award of punitive damages.

- For Rescission and Declaratory and Injunctive Relief

Sun, Dec 4, 2016 – Did you purchase a park owned or affiliate owned mobile home in a KSFG/SCM mobile home park? We're you offered a space rent special if you signed a long-term lease agreement? Does your long-term lease agreement contain a lease term section referencing a separately attached Lease Addendum?

The MHPHOA are currently investigating the alarming recurrence of “Same Space Turnovers” in Kort & Scott owned mobile parks. The data shows that the average length of mobile home ownership for many is broken down into three (3) timeframes; 12-16 months, 24-28 months and 36-40 months. These timeframes coincide with the 1, 2 and 3 year rent specials being offered for Kort & Scott affiliate owned mobile homes.

Many of these homeowners did not fully understand their long-term leases and found themselves in financial hardship within a short period of time. Their long-term leases contained an “Addendum” Clause which led to a “Right of First Refusal” and their mobile homes were purchased by a Kort & Scott company for a fraction of their value.

Buy Here. Pay Here. Stay Here.

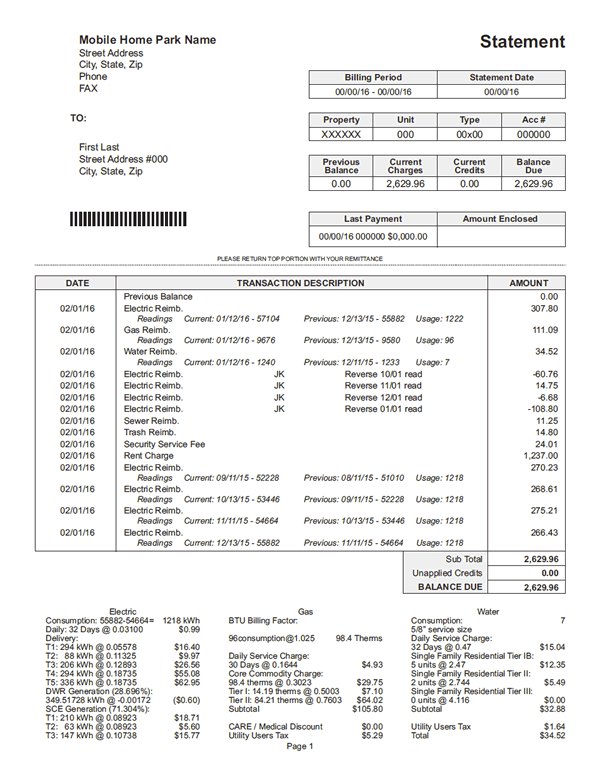

Sat, Dec 3, 2016 – Are you being overcharged for utilities? Is your electric bill more than you think it should be? Are you being overbilled for gas, water and sewage?

If you've answered yes to any of the preceding questions, you should file an informal complaint with the California Public Utilities Commission (CPUC) at 800-649-7570. Each mobile home owner who has been affected by utilities overbilling should file a separate informal complaint with the CPUC.

Once you've filed a complaint with the CPUC, it is suggested that you file a complaint with the Department of Housing and Community Development (HCD) for a Utility Bill issue which the HCD cannot assist you with, this is an information only exercise for the HCD. This provides an important paper trail that will be required at a later date.

History of Utilities Overbilling – 10 Years Ago in Arizona

Price Gouging Cited in High Electric Bills

Tue, Sep 5, 2006 – Phoenix, AZ – Expensive electricity bills are hitting residents of mobile homes and recreational vehicles in Arizona especially hard.

Some of the bills are being calculated at twice the rates charged to single-family houses.

‘There are many RV parks that are flat out price-gouging their tenants, and I think it needs to stop,’ said Corporation Commissioner Kris Mayes. ‘To be profiteering on electricity in the middle of the summertime is completely objectionable.’

Some manufactured-home residents, such as Scott Yount of Tempe, are taking matters into their own hands. He flipped off the streetlight in front of his trailer and padlocked the switchbox because he thinks he was paying to light the roadway.

The 48-year-old has been living in the 359-unit Chaparral Mobile Village for nearly 10 years. He said he started becoming troubled several months ago when his bill was higher than his next-door neighbor’s.

‘I keep my AC at 80, with a floor fan on, and at night there’s maybe one light bulb and a TV,’ said Yount, who lives alone. ‘Meanwhile, they have kids running everywhere and their bills were consistently lower by at least 50 percent or more.’

Abe Arrigotti, president of the California company that manages the Chaparral park along with 28 other parks, said he did not believe that was true. ‘If it was true, we would be happy to send an electrician out to fix the problem,’ he said.

Even so, many other residents face similar billing issues but are too scared or financially strapped to do anything, said attorney William Spence, a family practice attorney from Chandler. He says he speaks with frightened mobile-home-park residents almost daily.

Mayes is now asking her fellow commissioners to help solve the problem and is seeking to implement statewide legislation to curb such practices.

Arizona Daily Star

Chaparral Mobile Village

- Address: 400 West Baseline Road, Tempe, Arizona 85283

- County: Maricopa

- Phone: 480-839-3050

- Spaces: 359

- Type: Family

- Sold: Feb 2015, Amount: $23,850,000

Broker: Danny Douglas, Marcus & Millichap

Buyer: Cal-Am Properties - Management:

Kort & Scott/Sunset Management Corp

Fri, Dec 2, 2016 Updates – Here are 746 names, a small percentage of “human lives”, NOT chattel, that have been the victims of Kort & Scott Financial Group (KSFG) DBAs and Sierra Corporate Management (SCM) eviction proceedings in the California Civil Courts.

We’ve coined a new phrase for the process these individuals have endured for years, we call it being “Evictimized”, and refer to the human lives as “Evictims”, the victims of being victimized, and evicted from their mobile homes that many paid for in full – they rightfully owned their homes.

Hart | King Eviction – Sierra Corporate Management Being Sued for Fraud

Thu, Dec 1, 2016 – On Thu, Oct 27, 2016 the MHPHOA reported on a Civil Lawsuit filed by a resident against Continental Mobile Home Park and Sierra Corporate Management. We’ve extracted the General Allegations from the lawsuit for you to read. In summary, the timeline of events show fraudulent business practices and multiple violations of the California Mobilehome Residency Law (MRL).

Hart | King, A Professional Corporation, executed the Unlawful Detainer Lawsuit against the “Previous Owner” and the “Renter”, not the “Rightful Home Owner”. You’ll have to read the General Allegations below to fully understand how the “Previous Owner” and the “Renter” were used by the Kort & Scott DBA and Hart | King to nefariously obtain possession of the mobile home from the rightful owner.

The law firm of Hart | King, A Professional Corporation, has been responsible for the execution of hundreds of Unlawful Detainer Lawsuits for the Kort & Scott companies that own the mobile home parks. The MHPHOA have communicated with other evicted mobile home owners who also allege fraud that led to their eviction proceedings executed by Hart | King. The final outcome for these home owners was the loss of their mobile home and many have financial judgments against them in amounts up to $9,999 – and more.

Post Eviction – Sierra Corporate Management Being Sued for Fraud

- 2016-10-05 – Civil Lawsuit Filed by Resident

- Case Number: 30-2016-00879101

- Plaintiff vs. Continental MHP Associates LP, dba Continental Mobile Home Park, Sierra Corporate Management Inc, DOES 1 through 25

Complaint Summary

- Violation of Mobilehome Residency Law

- Fraud

- Conversion

- Unfair Competition

MUST READ – Civil Lawsuit General Allegations

- In or about May 2014, Plaintiff purchased a mobilehome located inside the Park at [Street Address, Space Number] Santa Ana, California 92703. The purchase price of the mobilehome was $34,000. Plaintiff purchased the mobilehome outright and registered title was transferred to her name.

- When Plaintiff purchased the mobilehome, Defendants acknowledged that Plaintiff was the new owner and made a copy of her identification and took down her contact information. Defendants, however, refused to change the existing space lease on the home to Plaintiffs name, and refused to enter into a new lease with Plaintiff. The existing lease was not in the name of the seller and prior occupant of the mobilehome, but rather in the name of an earlier owner who had owned the home and entered into the lease in 2009. Defendants told Plaintiff that the name on the lease could not be changed and that it had to stay in Previous Owner’s name until its (25-year) term expired. This was the first of many knowingly false statements that Defendants made to Plaintiff. There was no reason whatsoever that the Previous Owner’s lease could not be transferred or replaced with a new lease between Continental and Plaintiff (except, as later became apparent, to make it easier for Defendants to scam Plaintiff out of her home). Continue…

- Defendants instructed Plaintiff that each month, she should pay the rent by cashier check or money order in the name of Previous Owner. Plaintiff, a mono-lingual Spanish-speaker with limited education, believed Defendants and complied with the instructions. Previous Owner became aware of this situation and contacted Plaintiff. Previous Owner was concerned that there could be some adverse impact to his credit if the lease continued in his name and a non-payment or other problem arose between Defendants and a subsequent owner. Together, Plaintiff and Previous Owner approached Defendants and requested that the lease be changed. Defendants again refused. Seeing no recourse, Plaintiff continued to pay the rent in Previous Owner’s name.

- In early 2015, Plaintiff began renting a room in her home to a Renter. Renter soon became disruptive and destructive to Plaintiff’s mobilehome. The police came on more than one occasion due to Renter’s conduct. As Renter became more threatening, the police on one occasion suggested that Plaintiff leave the home temporarily for her safety and to avoid being implicated in any illegal activity. Frightened, Plaintiff did leave, but left her furniture and other personal possessions and continued to pay the rent. Plaintiff informed Defendants that she was leaving and that she was trying to evict. Defendants had Plaintiff’s phone number and knew where she would be staying.

- Plaintiff first filed an unlawful detainer action (Case No. 30-2015-00787920-CL-16 UD-CJC) in May 2015, in order to evict Renter from Plaintiff’s mobilehome. Plaintiff had no legal counsel and used self-help to represent herself. This first action was dismissed in June due to Plaintiff’s lack of familiarity with the procedures, so Plaintiff immediately filed a new action (Case No. 30-2015-00792121-CL-UD-CJC). On June 16, 2015, the Court issued a writ of possession.

- Plaintiff was informed that the Sheriff would be evicting Renter from the mobilehome on July 26, 2015. Accordingly, Plaintiff went to the Park that evening to verify that Renter was gone. When she arrived, she found that the Renter had been locked out of the mobilehome, but Renter and her boyfriend were still hanging around on the patio of the home. Plaintiff called the Sheriff to have them physically removed. Plaintiff then left that night to avoid the dangerous situation and allow the police to do their job.

- When Plaintiff returned the next day to check on her home, and planning to move back in, she found the windows and doors had been boarded up, barring any entry. She went to Defendant’s agent, the Park manager, and asked why her home was boarded up. The manager told her that the Sheriff had put up the boards and that the Park could not take the boards down until the Sheriff said it was ok. On information and belief, unbeknownst to Plaintiff at the time, this statement was false. The Sheriff had not boarded up Plaintiff’s house; rather, Defendants had caused the boards to be put up. But Plaintiff believed the Park manager and – feeling powerless to do anything in the face of supposed law enforcement action – Plaintiff again left.

- Plaintiff returned to the Park approximately a couple of weeks tater to find her home still boarded up. When she asked the manager about the situation, he said he could not give her any additional information. Plaintiff went away again.

- Approximately three weeks later, Plaintiff returned again to the Park. This time, the boards had been taken down and people were living in her mobilehome. Plaintiff immediately went to the Park manager, who told her the home had been sold and was being rented to new occupants. Plaintiff’s furniture, television, and other personal belonging were all gone from the house.

- Plaintiff would later come to find out that on or about July 9, 2015 (during the time Plaintiff was not living in her home and was trying to evict Renter), Continental filed an unlawful detainer action, naming the Renter and the Previous Owner (Case No. 30-2015-18-00797649-CL-UD-CJC.) Although Plaintiff was the registered owner of the mobilehome, and Defendants knew she was the registered owner, Plaintiff was not named in the unlawful detainer action, and was never served with the complaint or with any other documents relating to the proceeding. Plaintiff never received any notice of unpaid rent. Nor did Defendants ever tell Plaintiff – during her many visits to the Park - that unlawful detainer proceedings were pending that could result in the loss of her home. To the contrary, Defendants actively concealed this fact from Plaintiff and physically prevented her from lawfully re-taking possession of her home. When Defendants boarded up Plaintiff’s home in late July 2015, they had absolutely no legal basis to do so. No writ of possession had issued in Continental’s unlawful detainer proceedings. Indeed, the case was not even set for trial. By that date, all Continental had done was purportedly serve the complaint (by personal delivery to and by mail to Renter and Previous Owner at the address of Plaintiff’s mobilehome, where Defendants knew he had not lived for years.)

- Defendants then continued to board up Plaintiff’s house for several weeks, until Continental obtained judgment and executed on the writ of possession (Previous Owner of course defaulted in the unlawful detainer action, having never received any notice). All the while, Defendants refused to let Plaintiff into her home and claimed they had "no information." Then, when Plaintiff returned for the last time to find other people living in her home, Defendants lied yet again, telling Plaintiff her house had been sold. In fact, a title report on Plaintiff’s house states that escrow was opened months later, on December 30, 2015.

- The title report further states that the buyer of Plaintiff’s house was Two Palms Real Estate, LP. Plaintiff alleges on information and belief that Two Palms Real Estate is affiliated with Defendants (having the same address and individual agent for service of process). Plaintiff alleges on information and belief that, through this artifice, Defendants essentially sold Plaintiff’s house to themselves, and worse, did so for far less than fair market value. Plaintiff’s house has a value of at least $34,000. The judgment on Continental’s unlawful detainer action was for $9,733.60. No money from the sale of the house has ever been paid to Plaintiff.

- Defendants’ actions as alleged herein have wrongfully, intentionally, and maliciously taken advantage of Plaintiff’s vulnerability and lack of business and legal sophistication, and deprived her of her home and her possessions. Now homeless, Plaintiff has had to live in her car, on the streets, or with family.

The Kort & Scott 800 Pound Eviction Gorillas – SNE, HNE, SNE

Thu, Dec 1, 2016 – California is the only state in the nation with independent professional judges dedicated to ruling on attorney discipline cases. The State Bar of California investigates complaints of attorney misconduct. If the State Bar determines that an attorney’s actions involve probable misconduct, formal charges are filed with the State Bar Court by the bar’s prosecutors (Office of Chief Trial Counsel).

The independent State Bar Court hears the charges and has the power to recommend that the California Supreme Court suspend or disbar attorneys found to have committed acts of professional misconduct or convicted of serious crimes.

Also, it can temporarily remove lawyers from the practice of law when they are deemed to pose a substantial threat of harm to clients or the public.

The State Bar Court of California

California Attorneys Representing MHP Owners – Moral Turpitude

The MHPHOA.com would like to respectfully remind all attorneys representing mobile home park owners and practicing law in the State of California, you do have a Rules of Professional Conduct that you must adhere to. If you violate these Rules of Professional Conduct, you may be subject to disbarment.

What is Moral Turpitude

Moral Turpitude is a phrase used in criminal law to describe conduct that is considered contrary to community standards of justice, honesty, or good morals. Turpitude means a corrupt, depraved, degenerate act or practice. Moral turpitude generally refers to conduct that shocks the public conscience.

Disbarment – California Business and Professions Codes §6106 and §6107

-

6106. The commission of any act involving moral turpitude, dishonesty or corruption, whether the act is committed in the course of his relations as an attorney or otherwise, and whether the act is a felony or misdemeanor or not, constitutes a cause for disbarment or suspension.

If the act constitutes a felony or misdemeanor, conviction thereof in a criminal proceeding is not a condition precedent to disbarment or suspension from practice therefor.

- 6107. The proceedings to disbar or suspend an attorney, on grounds other than the conviction of a felony or misdemeanor, involving moral turpitude, may be taken by the court for the matters within its knowledge, or may be taken upon the information of another.

California Business and Professions Code Section 6100-6117

CIMT – Crimes Involving Moral Turpitude

Crimes Against Property: Accessory Before the Fact in Uttering a Forged Instrument, Attempted Fraud, Conspiracy to Commit Forgery, Encumbering Mortgaged Property with Intent to Defraud, Extortion, Forgery, Making False Statements of Financial Condition, Malicious Trespass, Obtaining Money by False Pretenses, Uttering a Forged Instrument

Example: Elder Financial Abuse

120. Defendants took, appropriated, obtained and/or retained or assisted in taking, appropriating, obtaining and/or retaining Senior Citizens’ mobilehomes by refusing to approve prospective purchasers of Plaintiffs’ mobilehomes, and by raising rents to unreasonably high levels. As a result Senior Citizen Plaintiffs were harmed and have been deprived of their right to sell their homes in the Park and have had to either walk away from their home or to sell them to Defendants for almost nothing.

121. Defendants’ actions and/or conduct alleged herein was done for a wrongful use, with intent to defraud and/or by undue influence by preventing Plaintiffs from selling their mobilehomes in place in the Park, or keeping them there at reasonable rent levels.

122. Defendants knew or should have known that their actions and/or conduct were likely to be harmful to Plaintiffs and would prevent Plaintiffs from being able to sell their mobilehomes in place in the Park and would result in Defendants taking the financial investments Plaintiffs have in their mobilehomes in violation of Elder Abuse and Dependent Adult Civil Protection Act. Defendants’ actions and/or conduct was a substantial factor in causing Plaintiffs’ harm. Plaintiffs seek all damages allowed under the Elder Abuse and Dependent Adult Civil Protection Act and all other remedies otherwise provided by law (including, but not limited to, rescission) to compensate them for the harm proximately caused by Defendants.