California MHP News

Mobile Home Owner News – Feb 2017

Resident curated news and important information regarding mobile home owners and residents in mobile home parks throughout the State of California.

Click/tap the story headlines to open a link to the full original story. Story headlines with are inline news stories.

Clicking or tapping links with a caret (kar-it, carrot) will expand/show additional content and change to to collapse/hide content. Content that is collapsed/hidden will not print.

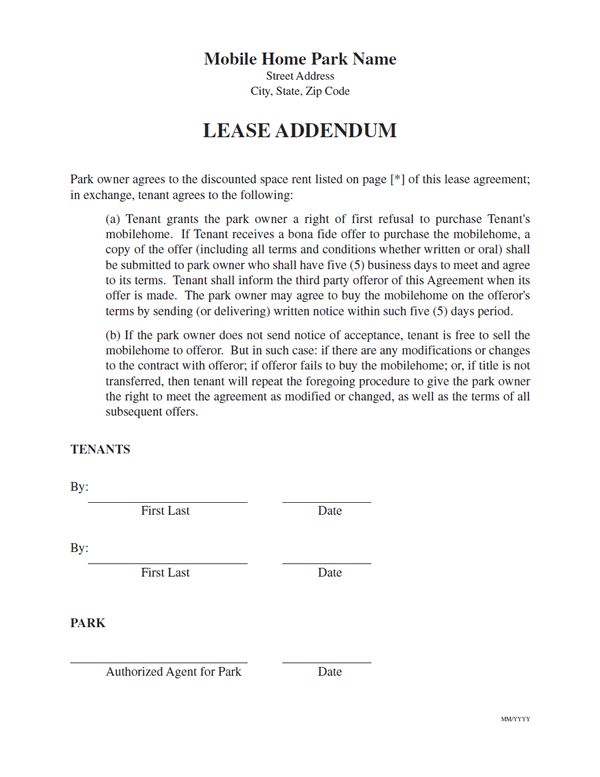

Mon, Feb 27, 2017 – Did you purchase a park owned or affiliate owned mobile home in a KSFG/SCM mobile home park? We’re you offered a space rent special if you signed a long-term lease agreement? Does your long-term lease agreement contain a lease term section referencing an *Addendum: Resident shall receive free rent…

?

A rental agreement entered into or renewed on and after January 1, 2006, shall not include a clause, rule, regulation, or any other provision that grants to management the right of first refusal to purchase a homeowner’s mobilehome that is in the park and offered for sale to a third party pursuant to Article 7 (commencing with Section 798.70). This section does not preclude a separate agreement for separate consideration granting the park owner or management a right of first refusal to purchase the homeowner’s mobilehome that is in the park and offered for sale.

Note the phrase shall not include a clause…

. Within the Sierra Corporate Management long-term lease agreement may be a Clause regarding an Addendum for free rent which is prefaced with an asterisk (*). That Addendum clause leads to a separate page titled Lease Addendum which contains the Park Owner Right of First Refusal to Purchase Home. This would appear to be in violation of Civil Code §798.19.5?

Park Manager Told to Push Sale of Park Owned Mobile Homes

Sun, Feb 26, 2017 – On Thu, Dec 1, 2016, documents were made available online regarding a Motion for Preliminary Injunction against Friendly Village Mobile Associates LP, Friendly Village MHP Associates LP and Friendly Village GP LLC, all Kort & Scott DBAs for Friendly Village Mobile Home Park in Long Beach, California which is managed by Sierra Corporate Management.

Within the 8 page Final Order denying the Motion for Preliminary Injunction, there is a Discussion Timeline regarding the Background of the case. On page 6 is a one paragraph summary of the previous [Park Manager]’s Declaration. It reads as follows and has been edited [Park Manager] to remove personally identifiable information.

Further, according to [Park Manager] (who served as the Park manager from March 1, 2014 until September 2015), says that after a resident was evicted, she was instructed to get the Park-owned mobile home unit ready for sale and to list it at a price below the rate of other mobile homes in the Park. She says she did as she was instructed and would have the mobile home units from evicted residents listed for sale at a price of approximately 2/3 of other units listed in the Park at the time. [Park Manager] also says that she was told to push the sale of the Park-owned units over those of other residents when prospective buyers came to the Park. Also, [Park Manager] claims the paperwork to and from Sierra for prospective buyers who were interested in Park-owned units took place very quick whereas paperwork to and from Sierra for prospective buyers interested in resident-owned units took place very slowly.

Acosta v. City of Long Beach – Department 310 – Law and Motion Rulings

Friendly Village Mobile Home Park

5450 North Paramount Boulevard, Long Beach, California 90805

- 2015-08-15 – Civil Lawsuit Filed by Residents

- Case Number: BC591412

- Plaintiffs 1-XXX vs. Friendly Village of Long Beach

- Status: In Progress

Complaint Summary: Failure to Maintain Mobilehome Park, Breach of Contract, Negligence, Negligent Infliction of Emotional Distress, Continuing Trespass, Public Nuisance, Private Nuisance, Inverse Condemnation, Unfair Business Practices.

Park Manager: Company Wanted to Teach Me How to do Illegal Sales

Mon, Oct 24, 2016 – Sierra Corporate Management Onsite Community Manager Review of Lamplighter Sacramento Mobile Home Park: 2016 Mar – I am a calm and a peaceful person. I love all my jobs and give 100%. This company wanted to teach me how to do illegal sales. I told them that let's fix the homes and then sell them but this statement offended them and I ended up being the bad employee. Legally we are supposed to have a Property Manager, Assistant Manager and a full time Maintenance person. Instead, I was the only Property Manager there and we had a part time porter (not maintenance). As me being a great employee, I continued working there and doing 3 person's jobs all by myself. I know I was learning and, learning is the key to success. I will find a better job and be successful as I am a hard worker and a leader.

Onsite Community Manager (Former Employee)

Kort & Scott DBAs Being Sued by Residents of Reseda Mobile Homes

Sat, Feb 25, 2017 – In Mar 2014, Kort & Scott purchased Reseda Mobile Homes (108 Spaces) located at 6545 Wilbur Avenue, Reseda, California 91335, for $13.1MM from Daniel C. Fischer (Reseda Mobile Associates LP).

On Thu, Feb 16, 2017, 90+ residents from Reseda Mobile Homes filed a Civil Lawsuit (Case No: LC105272) against the Kort & Scott companies that own the park including Sierra Corporate Management. James C. Allen of ASK Law Group is the attorney/law firm representing the residents.

This is a new Civil Lawsuit filing and there are no documents available online yet. The MHPHOA will be monitoring the progress of this lawsuit and will post additional information as it becomes available.

Congratulations to the residents of Reseda Mobile Homes and kudos to the boots on the ground group who helped make this happen!

Notice of Intention to Commence Action

Dear Parkowner(s)/Management:

I write to you on my own behalf and on behalf of other current and former homeowners and residents of Reseda Mobile Homes (hereinafter “the Park”), located at 6545 Wilbur Ave., Reseda, CA 91335. We have retained the law firm of Allen, Semelsberger & Kaelin, LLP (ASK Law Group) to represent us regarding the maintenance of the Park. This letter is written on the firm’s letterhead in order to provide you with our attorneys’ contact information should you have any questions regarding this correspondence. To that end, please direct any questions you may have regarding this notice to our attorneys, who can be reached at the address and telephone number listed above.

California Civil Code section 798.84 requires that at least thirty (30) days prior to taking legal action against you, at least one homeowner on behalf of the residents, must send this notice. This notice lists the problems I and/or other homeowners and residents have had in the Park and the remedies we seek. This notice includes problems that at least one homeowner/resident has suffered in the last four years, and lists the potential legal remedies we may have.

Park maintenance problems, other inadequate Park conditions, management violations, and reduction or failure to provide services include, but are not limited to:

- General damages for all of the foregoing.

- Special damages according to proof, including but not limited to damages for wage loss, emotional distress, physical injury, medical expenses, and other physical problems.

- Prejudgment interest on the amount of any damages.

- Loss of use and enjoyment; damage to quiet enjoyment.

- Overpayment of rent.

- Property and home damage.

- Statutory penalties.

- Declaration of residents’ and managements’ rights and obligations.

- Treble and punitive damages.

- Attorneys’ fees and costs.

- Injunctions to enjoin owner’s, management’s and its agents’ conduct, abate nuisances and enjoin unfair and unlawful business practices.

- Disgorgement of profits and restitution of losses.

- Such other and further relief or remedy as a court may deem just and proper, or is allowed under any California or federal law.

Reseda Mobile Homes

- Address: 6545 Wilbur Avenue, Reseda, California 91335

- County: Los Angeles

- Phone: 818-345-6345

- Spaces: 108

- Type: 55+

- 2017 Space Rent: $1,450

- Purchased: Mar 2014, Amount: $13,100,000

- Refinanced: Jun 2016, Amount: $10,300,000

Loan Type: Fannie Mae SARM, Chad Thomas Hagwood - Management: Sierra Corporate Management

- DBA: Reseda GP LLC, Reseda MHP Associates LP

- DBA Filing: Jan 2014

Civil Lawsuits Against Kort & Scott Companies

Ten (10) Civil Lawsuits – Four (4) Civil Lawsuits in Progress

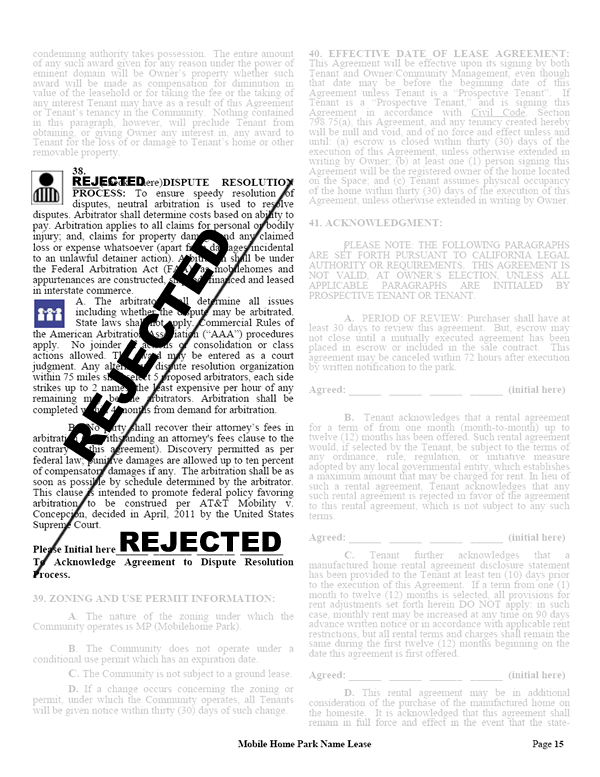

SCM Long-Term Leases – Alternative Dispute Resolution (ADR) Clauses

Fri, Feb 24, 2017 – What is a Alternative Dispute Resolution or ADR Clause? It is any method of resolving disputes other than by litigation and is abbreviated as ADR. Public courts may be asked to review the validity of ADR methods, but they will rarely overturn ADR decisions and awards if the disputing parties formed a valid contract to abide by them. Arbitration and mediation are the two major forms of ADR.

Kort & Scott (dba Sierra Corporate Management) long-term lease agreements usually contain an ADR Clause. The MHPHOA advise all homeowners to REJECT any ADR Clauses presented in leases or rental agreements. We have been informed that this process is not in your best interest, particularly when it comes to Kort & Scott arbitration procedures.

If you find yourself in a situation where you have been coerced into signing a Kort & Scott long-term lease agreement, do not initial the area DISPUTE RESOLUTION PROCESS. Draw a diagonal line through the entire section and write the word REJECTED on the line. As an added precaution, write the word REJECTED on the “Check Here” line at the beginning and the “Initial Here” lines at the end.

28. ATTORNEY’S FEES AND COSTS: In any action arising out of Tenant’s tenancy, this Agreement, or the provisions of the Mobilehome Residency Law, the prevailing party will be entitled to reasonable attorneys’ fees and costs. A party will be deemed a prevailing party if the judgment is rendered in his or her favor or where the litigation is dismissed in his or her favor prior to or during the trial, unless the parties otherwise agree in the settlement or compromise.

38. Rejected (Check Here) DISPUTE RESOLUTION PROCESS: To ensure speedy resolution of disputes, neutral arbitration is used to resolve disputes. Arbitrator shall determine costs based on ability to pay. Arbitration applies to all claims for personal or bodily injury; and, claims for property damage and any claimed loss or expense whatsoever (apart from damages incidental to an unlawful detainer action). Arbitration shall be under the Federal Arbitration Act (FAA), as mobilehomes and appurtenances are constructed, shipped, financed and leased in interstate commerce.

A. The arbitrator shall determine all issues including whether the dispute may be arbitrated. State laws shall not apply. Commercial Rules of the American Arbitration Association (“AAA”) procedures apply. No joinder of actions or consolidation or class actions allowed. The award may be entered as a court judgment. Any alternative dispute resolution organization within 75 miles shall select 5 proposed arbitrators, each side strikes up to 2 names, the least expensive per hour of any remaining may be the arbitrators. Arbitration shall be completed within 4 months from demand for arbitration.

B. No party shall recover their attorney’s fees in arbitration (notwithstanding an attorney’s fees clause to the contrary in this agreement ). Discovery permitted as per federal law; punitive damages are allowed up to ten percent of compensatory damages if any. The arbitration shall be as soon as possible by schedule determined by the arbitrator. This clause is intended to promote federal policy favoring arbitration to be construed per AT&T Mobility v. Concepcion, decided in April, 2011 by the United States Supreme Court.

Please Initial Here Rejected

To Acknowledge Agreement to Dispute Resolution Process.

What is Arbitration?

Arbitration uses a neutral third person to resolve a dispute instead of going to court. Unless the parties have agreed otherwise, the parties must follow the arbitrator’s decision.

What is an Arbitrator?

An arbitrator is a neutral third person, agreed to by the parties to a dispute, who hears and decides a dispute. An arbitrator is not a judge, but the parties normally must follow the arbitrator’s decision and the decision is said to be “binding” on the parties.

What is the Arbitration Process?

Arbitration is a binding adjudication of the parties’ claims and defenses by a neutral arbitrator (or group of arbitrators). The arbitrator’s ruling or award is ultimately binding on the parties as if it were rendered by a court as a final judgment. Unlike a judgment, however, the award has no force of law behind it. The judgment is a private determination and the arbitrator has no lawful authority to compel enforcement of the award.

Unlike mediation, arbitrations have a formal procedure. Arbitration demands and responses are filed, discovery often is conducted, and evidence and testimony are marshaled and preserved. The case is then tried and an award is rendered. The whole process can take days, weeks, or months, depending on the complexity of the dispute, the number of parties, and the schedules of the parties, the lawyers, and the arbitrators.

Is the Arbitration Process Less Expensive?

Arbitrations generally tend to be more procedurally streamlined than litigation and the parties ordinarily have only limited appellate rights (if any). Arbitrations often can be faster and cheaper than court actions. Many litigators still say that they can get to trial in court as fast (or faster) than they can have a dispute arbitrated. The speed with which a dispute can be adjudicated by a court will depend on a number of factors, not the least of which is the court’s calendar and local fast-track rules.

The expense of an arbitration is another thing that the lawyer should consider with the client. In many jurisdictions, the “hard costs” of a trial (such as the judge’s and clerk’s salaries and other administrative expenses) are paid by taxpayers. In an arbitration, the parties typically pay for the arbitrator’s costs and other administrative expenses. If the parties have a fee and cost recovery clause in their contract, the losing party may end up paying all of the costs of arbitration and the attorney’s fees and costs incurred by the prevailing party.

The Difference Between Arbitration and Mediation

Mediation involves assistance from an impartial third person, called a mediator, who helps the tenant and landlord reach a voluntary agreement on how to settle the dispute. The mediator normally does not make a binding decision in the case.

Arbitration involves referral of the dispute to an impartial third person, called an arbitrator, who decides the case. If the landlord and tenant agree to submit their dispute to arbitration, they will be bound by the decision of the arbitrator, unless they agree to nonbinding arbitration.

1. Leases 2. Sample 3. Incentives 4. Unconscionable 5. Forbearance 6. Addendums

Thu, Feb 23, 2017 – On Sat, Jan 7, 2017, the MHPHOA had the pleasure of speaking with Counselor Duffy McCarron at length regarding her case and the predatory business practices of Hart | King. The MHPHOA are offering our services to assist the Counselor with her ongoing investigations and we’ve setup a section on the MHPHOA for Hart | King research and reporting.

Note: Hart | King, A Professional Corporation located at 4 Hutton Centre Drive, Suite 900, Santa Ana, California 92707, is the law firm used by Kort & Scott dba Sierra Corporate Management (SCM) to nefariously evict mobile home owners stripping them of their financial assets in the process.

Hart | King Racketeering CIMT Auctions

On Tue, Mar 1, 2016, an open letter from Nancy Duffy McCarron, CBN 164780, was sent to Kamala Harris, the Attorney General of California. The opening paragraph reads…

Open Letter on Behalf of the People of the State of California

On behalf of the PEOPLE of the STATE of CALIFORNIA we petition an investigation of an ongoing racketeering enterprise orchestrated by Robert Williamson, Ryan Egan, John Pentecost and others at HART|KING, 4 Hutton Center Drive, St 900, Santa Ana, CA 92707. The enterprise was designed to steal mobile homes in California and Western United States to enrich wealthy park owners. Park owners pay HART|KING to prosecute unlawful evictions to steal homes from private owners who are rendered homeless after this grand theft of assets.

HART|KING orchestrates this racketeering enterprise to steal mobile homes by: Continue Reading…

Monarch Home Sales – Commission Gouging at 29% Commission Rates

Wed, Feb 22, 2017 – In Feb 2017, a 1970 mobile home sold in Friendly Village Mobile Home Park for $24,000. The HCD Retailer handling the mobile home sale was Emily Tice from Monarch Home Sales.

A commission of $5,000 to seller’s agent (Monarch Home Sales) and $2,000 to buyer’s agent (Pat Owens Realty), a total of $7,000, was deducted from the $24,000 leaving the seller $17,000 with additional fees to be deducted from that – a 29% commission rate.

The MHPHOA believe there is a legal term for this and it is referred to as “Unjust Enrichment”.

Unjust enrichment is a legal concept referring to situations in which one person is enriched at the expense of another in circumstances which the law treats as unjust.

Note: The homeowner did agree to the above commission amounts – under duress. The mobile home had been on the market for 22 months and they wanted out of Friendly Village Mobile Home Park. They were willing to do whatever was required to make it happen.

Mobile Home Sales Commissions – Enact Legislation to Stop Commission Gouging

It is time to enact legislation limiting the amount of commissions that can be earned when selling mobile or manufactured homes. The MHPHOA along with other concerned organizations are currently discussing a proposal for this type of legislation that would provide a “fair and just” return for mobile home sales.

Real Estate Broker Commissions – For Reference

The average Realtor commission in California is 6%. The total commissions are usually split 50/50 between the seller and buyer agents.

Mobile home sales commissions are structured differently than Realtor commissions. Many mobile home Retailers operate on a “reasonable” flat rate commission agreed to in advance. Most mobile home Retailers are licensed via a Dealer and/or Occupational License issued and regulated by the California Department of Housing and Community Development (HCD) – they are not Realtors.

Listing History and Timeline of Events

- Sep 2013 – Mobile Home Purchased for $25,000 and $950 Space Rent

Retailer: Southwest Mobile Homes - Feb 2014 – FVMHP Purchased by Kort & Scott Financial Group dba Sierra Corporate Management

- Nov 2014 – Mobile Home for Sale at $25,000

Retailer: Maple Ridge Mobile Homes - Apr 2015 – Mobile Home for Sale at $25,000

Retailer: Main Street Realtors - Nov 2015 – Mobile Home for Sale at $25,000

Retailer: Your Home Realty - Sep 2016 – Mobile Home for Sale at $25,000

Retailer: Excellence Real Estate - Oct 2016 – Mobile Home for Sale at $25,000

Retailer: Monarch Home Sales - Feb 2017 – Mobile Home Sold for $24,000 and $1,350 Space Rent

Retailer: Monarch Home Sales

This mobile home was originally purchased in Sep 2013 from Southwest Mobile Homes for $25,000 and $950 space rent which included some utilities. In Feb 2014, residents were informed that Sierra Corporate Management was taking over management of the park. In May 2014, not long after purchase, the homeowner received notice that their rent would be increasing $129 and utilities would be billed separately.

Due to the significant rent/utility increase in one year, homeowner decided to sell 14 months after purchase and originally listed mobile home for sale in Nov 2014. After approximately 22 months of listing with various Retailers with no success, homeowner resorted to their last option of listing with Emily Tice from Monarch Home Sales, who is closely affiliated with Kort & Scott dba Sierra Corporate Management. The mobile home sold within three (3) months.

We are informed that during the 22 months of listings, there were at least 20 interested buyers who were referred by the seller to Sierra Corporate Management to discuss qualifying for tenancy. Not one of those buyers was heard from again. It was later learned that the prospective buyers were being presented with additional “move-in” costs and income requirements of 3X the current space rent e.g. $1,350 x 3 = $4,050. We’ve reported on this process previously, the MHPHOA believe this is Interference with Mobile Home Sales and thousands of Kort & Scott homeowners have experienced this when selling their mobile homes.

Homeowner Documented Timeline of Events

May 29, 2013 – Friendly Village Mobile Home Park lawsuit vs. SFL Paramount LLC. Court denied the park an anti-slapp motion. Court records indicated “that the problems with the park had been occurring long before SFL began construction work and that Friendly Village knew of the problems.” “The effects of building on top of garbage-settlement and cracking concrete were open and obvious.” “The park alleged that damage to the soils, hardscape and structures, including fissures, cracks and sinkholes were due to SFL’s construction work.”

Aug 31, 2013 – I signed a $950 per month park rental agreement disclosure and the park listed “no known substantial defects, no pending lawsuits against the park affecting the facilities or alleging defects in the facilities.”

Oct 14, 2013 – An engineering geologist from the Source Group Inc performed a study of the park on behalf of Paramount Petroleum Corp.

Findings: A report issued by them revealed “there are extremely hazardous environmental conditions existing in the subsurface below the park. These conditions have been observed and reported by a number of governmental agencies. These studies identified the fact that historic leaking and disposal practices in the park parcel have resulted in the release of petroleum hydrocarbons and other contaminants including diesel fuel, gasoline, waste oil, metals and volatile organic compounds. These conditions have not been mitigated. Inhalation of toxic gases such as CO2, H2s and other VOCs, including methane, pose an extreme safety hazard.”

Aug 22, 2014 – Due to the $129.00 rent increase, I mailed a letter to Sierra Corporate Management requesting a “Rental Assistance Application.”

Sep 11, 2014 – Received SCM’s response stating, “Truly sympathize for your current hardships although as a homeowner, you need to have lived in your coach at least 3 years to qualify.”

Jun 9, 2015 – Due to Fair Housing Discrimination, I submitted an online complaint letter to the Department of Fair Housing (DFEH) commission and stated, “Additional information regarding future rent or fee increases was not disclosed by the park manager at the time of renting.

- Feb 5, 2014 – I received a notice from Sierra Corporate Management, that they assumed management of the park and it was under new ownership.

- Apr 28, 2014 – I received a 90-day notice of separate trash utility fee of $14.16 per month.

- May 29, 2014 – I received notification of an increase in space rent in the amount of $129 per month effective Sep 1, 2014.

- Jul 24, 2014 – I received a notice from the park encouraging me to apply for rental assistance and on Sep 11, 2014 it was rejected based that I had not lived in the park 3 years.

- Dec 1, 2014 – I received a rate change to security guard fee from 25.00 to 22.02 and trash from $14.16 to $17.30 per month.

- May 1, 2015 – I received another rate change in security guard fee and utilities.

- May 27, 2015 – I received notification of an increase in space rent in the amount of $129 per month effective Sep 1, 2015.

My grievance is that the park management never gave me a notice of planned park sale prior to purchasing my mobile home. In conclusion, I have had my mobile home on the market twice to no avail. The park management is requiring the new tenants to pay $1,350 per month. I noticed online that there are two other park owned homes listing space rental at $100-$150 less than mine. I inquired about this with park management.”

No Response

Jun 9, 2015 – I submitted an online complaint letter to Department of Consumer Affairs and Business Affairs regarding the same.

Jun 14, 2015 – I received a response via email from Cathy Mikuni, Department of Consumer and Business Affairs stating, “There are no easy solutions to my issues with the mobile home park and I may need to seek legal advice on actions I can take.”

Aug 13, 2015 – Park tenant attorneys filed a civil lawsuit against park.

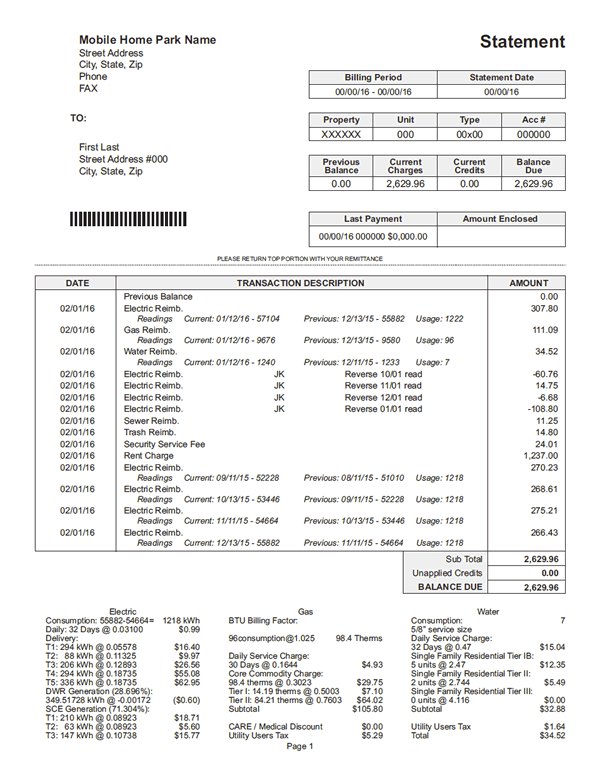

Nov 20, 2015 – I received a park rental statement. It reflected an account error that charged instead of credited my account. I brought it to the park manager’s attention and she stated, “Oh, you caught it?” She allowed me to deduct it from my remittance and initialed the statement although she did not issue a park memo notifying the other park tenants of the error.

Jan 11, 2016 – I filed an online request for assistance from the HCD OMBUDSMAN requesting that the park’s recent Health and Safety violations be investigated.

No Response

Jan 26, 2016 – I filed another online request for assistance from the HCD OMBUDSMAN requesting a utility bill investigation be conducted for overages during the months of 10-2015, 11-2015 and 12-2015.

No Response

Jan 26, 2016 – I received a response letter from HCD determining that the information I provided is related to Health and Safety issues. An inspector from the Riverside office was to contact me.

No Response

Feb 1, 2016 – I faxed the park utility overages to Nick Jiles, Assistant to District Director, 33rd District.

No Response

Apr 27, 2016 – I received a response letter from HCD OMBUDSMAN determining that my request for utility bill assistance are concerns for civil issues and to consult legal assistance.

May 31, 2016 – I gave park manager written notice of “First Option to Purchase” my home and intent to sell due to anticipated $149 rent increase in Sep 2016.

No Response

Jul 27, 2016 – In a letter from Sal Poidomani with HCD, and addressed to Sierra Corporate Management President Richard Pinel, it states, “In the spirit of cooperation and courtesy to the park residents, you agreed to hold community meetings to keep the residents apprised of the efforts and provide pertinent information.”

No Response

Aug 26, 2016 – I gave the park manager a letter from my doctor stating that I suffer from asthma and that due to the park’s recent construction near my residence, it has made it difficult for me to breath. I am also asking them to relocate me away from the construction.

No Response

Sep 20, 2016 – Sent an email letter to Henry Heater, Attorney at Law, requesting assistance in taking a class action lawsuit for personal injury.

No Response

1,000+ Mobile Homes Being Tracked in Kort & Scott Mobile Home Parks

Tue, Feb 21, 2017 – We are currently tracking 1,000+ mobiles homes in the Kort & Scott (KSFG) dba Sierra Corporate Management (SCM) inventory. We continue to acquire sales information for the KSFG/SCM mobile home parks and will post additional data once vetted.

Note: 3 Step Process – Step 1: Eviction, Step 2: Auction, Step 3: For Sale

BHPH 1/3 Evict 2/3 Auction 3/3 Sell Turnover

We’ve recently added real-time statistics for mobile home sales. Click/tap the “Mobile Home Sales Statistics” link below to show/hide statistical data.

Mobile Home Sales Statistics

Real-Time Dataset: Mon, Mar 9, 2026

- Dataset: 3,322 Mobile Home for Sale Listings from 2013-2026 for 40 Mobile Home Parks Owned by KSFG DBAs

- Average Sale Price 1: $92,163

- Sale Price Range: $90-$450,000

- Includes 1117 Mobile Homes at $100,000+

- Dataset: 3,165 Mobile Home Sales

- Average Sale Price 2: $46,076

- Sale Price Range: $90-$99,999

- Excludes 1117 Mobile Homes at $100,000+

- Dataset: 2,048 Mobile Home Sales

- Average Space Rent: $1,576

- Space Rent Range: $387-$2,900

- Average Mobile Home Year: 1985

- Year Range: 1943-2026

-

2010-2026107

-

2000-2009591

-

20**-20**4

-

1990-1999475

-

1980-1989433

-

1970-1979959

-

1960-1969450

-

1950-195916

-

1940-19493

-

19**-19**67

-

Unknown163

-

- Tracked Listings by Year Advertised

-

2025288

-

2024253

-

2023218

-

2022283

-

2021192

-

2020208

-

2019221

-

2018358

-

2017283

-

2016386

-

2015210

-

2014158

-

2013154

-

- Inventory value of 3,322 mobile homes in the Kort & Scott inventory as of Mon, Mar 9, 2026.

- Sale: 183 at $31,359,822

- Sold: 3,139 at $260,336,994

- Total: 3,322 at $291,696,816

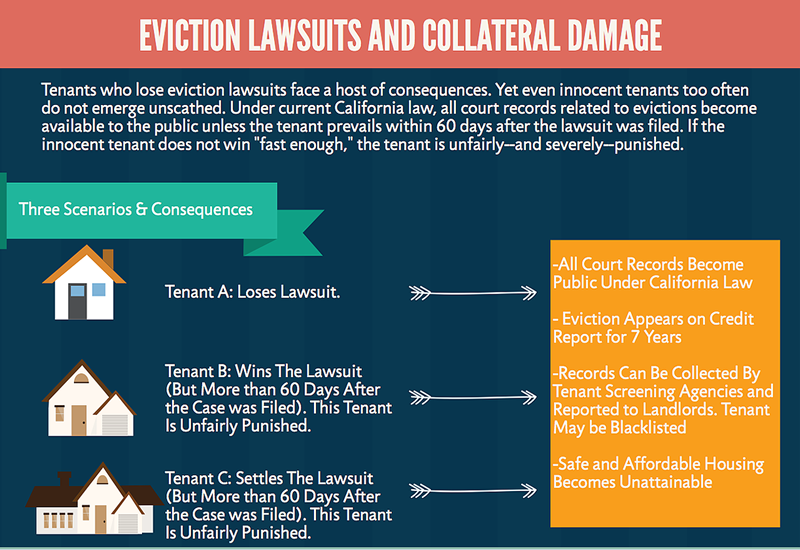

Mon, Feb 20, 2017 – If an Unlawful Detainer Lawsuit is filed against you (the registered mobile home owners and/or occupants), it could result in a judgment against ALL of you which may include monetary amounts, attorney fees, and other court costs as permitted by the California Mobilehome Residency Law §798.56a.

Once a lawsuit is filed with the court, it becomes public record and may appear on your Credit Report later or, have a negative impact on your credit even if no judgment is entered against you or the lawsuit is later dismissed.

As required by law, you are hereby notified that a negative credit report reflecting on your credit record may be submitted to a credit reporting agency if you fail to fulfill the terms of your credit obligations. This could seriously affect your ability to obtain credit or rental housing in the future.

California AB 2819 – Tenant Privacy Protections Passed

Fri, Sep 16, 2016 – Good news! Governor Jerry Brown just signed AB 2819* to protect the privacy, credit, and reputation of tenants who are involved in eviction lawsuits. It is a commonsense and much-needed reform to make sure that only tenants who lose an eviction lawsuit end up with an eviction on their record. Many tenants ended up with bogus evictions on their record just because their settlement agreement didn’t ensure their privacy or the eviction process took longer than 60 days. An eviction on your record means your credit is ruined for years.

This bill is co-sponsored by Western Center on Law & Poverty (WCLP) and the California Rural Legal Assistance Foundation.

Kort & Scott R&Rs – Only New, Not Used, Mobilehomes Permitted

Sun, Feb 19, 2017 – Is Kort & Scott dba Sierra Corporate Management removing newer mobile homes from your park and replacing them with what appear to be substandard older used mobile homes? Have you ever wondered why this is being done?

There is a calculation used in the industry to determine the valuation of your mobile home. For every $10 per month increase in space rent, you lose approximately $1,000 in equity. For example, if your space rent went up $100 per month in one year, the equity in your mobile home diminishes by $10,000.

When Kort & Scott purchase a mobile home park, the first order of business is to egregiously raise space rents for existing residents and set a new market rate for potential buyers. For example, the residents of Corona La Linda were paying $650 month space rent before Kort & Scott purchased their mobile home park in May 2015. After purchase, rents were raised 20% to $780. New buyer space rents were raised 46% from $650 to $950.

This type of predatory practice by Kort & Scott ensures that the resident owned mobile homes will be a challenge to sell to anyone other than a Kort & Scott affiliate for a fraction of its value. The immediate increase from $650 to $950 for new buyers causes the existing mobile home values to plummet.

Why are newer mobile homes being moved out? Because they have little value (equity) when sitting on Kort & Scott owned/leased land. They would never sell for what they are worth so they have to be removed from the park and taken to parks not owned by Kort & Scott. We’ve seen this process occur over and over again throughout most of the Kort & Scott mobile home parks.

Kort & Scott Rules and Regulations

Read your park Rules and Regulations. Many of the Kort & Scott R&Rs have a clause in them preventing all but new homes from being brought into the park. Here are two (2) R&R examples…

6. To ensure architectural compatibility, construction and installation standards, all incoming mobilehomes must be new, not previously resided in or occupied, and current model year, and comparable to other mobilehomes in the park in condition and appearance before entering the park.

Fountain Valley Estates R&Rs

8. All mobilehomes coming into the Park for the first time must meet the following requirements: Only new, not used, mobilehomes are permitted.

Tustin Village Mobile Home Park R&Rs

Tustin Village Mobile Home Park R&R Violations

Examples: These two (2) mobile homes (109 South Portola Lane, 108 South Colombo Lane) were scheduled for demolition at another mobile home park, brought into Tustin Village Mobile Home Park in direct violation of the Park Rules and Regulations, installed backwards, rehabbed on site, and resold to uninformed families.

2017 MRL: Article 3 – Rules and Regulations

The owner of the park, and any person employed by the park, shall be subject to, and comply with, all park rules and regulations, to the same extent as residents and their guests.

798.23 – Application to Park Owners and Employees

Suggested Solutions

Option 1: If you find that Kort & Scott are degentrifying your mobile home park by replacing newer homes with older homes and your Rules and Regulations have a clause to the above effect, you may be able to take Sierra Corporate Management to Small Claims Court for willfully violating the Rules and Regulations. Each willful violation can cost Kort & Scott up to $2,000 in penalties.

Stop Kort & Scott from degentrifying your mobile home park. Take them to court and force them (injunction) to follow their own Rules and Regulations.

Option 2: Do you have what you think are substandard mobile homes, manufactured homes, and/or recreational vehicles in your mobile home park managed by Sierra Corporate Management? Submit an HCD Online Complaint today for a “A Substandard Structure Issue”.

What’s good for the goose, is good for the gander.

Sat, Feb 18, 2017 Updates – Over 100+ reviews and complaints from Sierra Corporate Management residents, SCM employees, buyers and sellers of mobile homes, City Council Members and other officials. These are mobile home parks in California managed by Sierra Corporate Management (SCM) and owned by a Kort & Scott Financial Group KSFG) company.

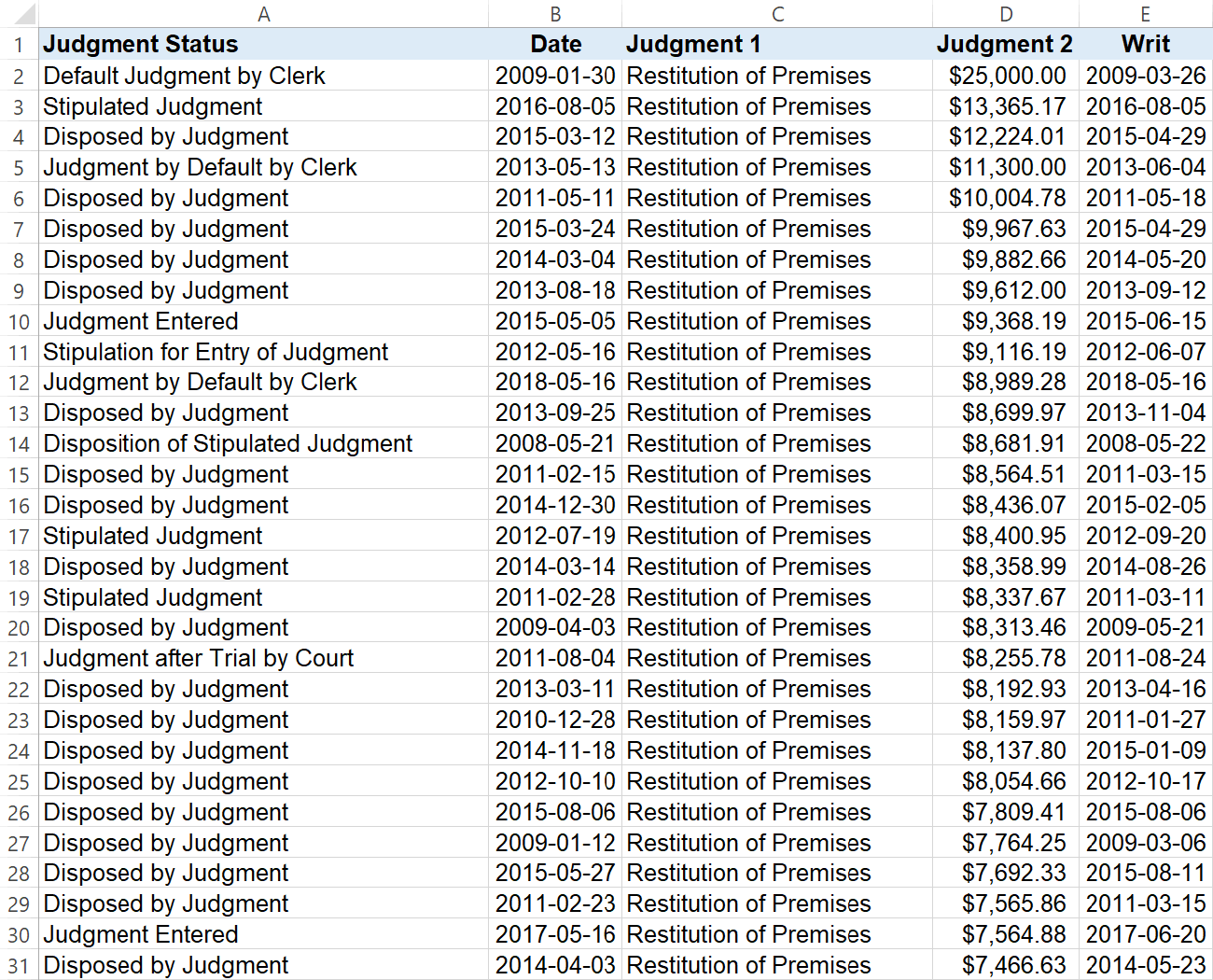

Fri, Feb 17, 2017 Updates – Here are 746 names, a small percentage of “human lives”, NOT chattel, that have been the victims of Kort & Scott Financial Group (KSFG) DBAs and Sierra Corporate Management (SCM) eviction proceedings in the California Civil Courts.

We’ve coined a new phrase for the process these individuals have endured for years, we call it being “Evictimized”, and refer to the human lives as “Evictims”, the victims of being victimized, and evicted from their mobile homes that many paid for in full – they rightfully owned their homes.

Kort & Scott Eviction Related Articles

- 2016-12-30 – Hollydale Mobile Home Park – 13% Eviction Rate in 2015

- 2016-12-17 – Mobile Home Park Evictions Help – Are You Facing Eviction?

- 2016-12-01 – Hart | King Eviction – Sierra Corporate Management Being Sued for Fraud

- 2016-11-16 – Stop Predatory Evictions in Mobile Home Parks

- 2016-10-27 – California Mobile Home Owners with Illegal Immigration Status

- 2016-10-03 – Lincoln Center Mobile Home Park – Evicted 1 Year After Purchase

- 2016-07-13 – Arrowhead Mobile Home Park – Eviction Stories

Thu, Feb 16, 2017 – Residents of Corona La Linda Mobile Home Park have been attending City Council Meetings and informing the Corona City Council that they are being overcharged for utilities (water) since Kort & Scott purchased their park in May 2015. Council Members performed their own review of the utility bills presented and told the residents they were not being overcharged. The residents knew otherwise and took their grievances, and proof, to the Riverside County Weights and Measures (W&M) office.

W&M requested the master water bills from Sierra Corporate Management and after investigation found that Sierra Corporate Management was/is overcharging residents for their water usage. SCM is now issuing credits to residents for the water billing overcharges. In one instance, a resident was credited $280 for a water calculation adjustment for the period 11/2015 thru 12/2016. Another resident was credited $138 and another $110 for the same time period.

Note: If you receive your utility bill(s) directly from the utility company(ies), this article does not apply to you.

Do you think you are being overcharged for utilities? If you live in a mobile home park owned by Kort & Scott and managed by Sierra Corporate Management (A Kort & Scott Company), there is a strong possibility that you are being overcharged for your utilities which are managed by the park owners. Complaints about the overbilling of utilities by Sierra Corporate Management are constant.

You could do what the residents of Corona La Linda Mobile Home Park have done and contact your local Weights and Measures Department. You’ll want to have enough proof available to show W&M that your utility bills are higher than normal and you think there is a problem with your meter or the park owners are overcharging you for utilities. W&M will inspect your meter(s) and perform any necessary adjustments and/or repairs.

If W&M find a discrepancy in the billing amounts, they will request the master bills from Sierra Corporate Management at which time any and all overcharges would be visible. You may end up being credited for the overbilling just like the residents at Corona La Linda Mobile Home Park.

We’ve provided links in the article to the Weights and Measures agencies in each county where Kort & Scott own mobile home parks.

Corona La Linda Mobile Home Park

- Address: 777 South Temescal Street, Corona, California 92879

- County: Riverside

- Phone: 951-734-1094

- Spaces: 132

- Type: Family

- 2017 Space Rent: $950

- Purchased: May 2015, Amount: $16,700,000

Broker: Robert M. Paez, Martinez and Associates - Management: Sierra Corporate Management

- DBA: Corona La Linda Associates LP, Corona La Linda GP LLC

- DBA Filing: May 2015

Sierra Corporate Management Utilities Overbilling

Sat, Dec 3, 2016 – Are you being overcharged for utilities? Is your electric bill more than you think it should be? Are you being overbilled for gas, water and sewage?

If you’ve answered yes to any of the preceding questions, you should file an informal complaint with the California Public Utilities Commission (CPUC) at 800-649-7570. Each mobile home owner who has been affected by utilities overbilling should file a separate informal complaint with the CPUC.

Once you’ve filed a complaint with the CPUC, it is suggested that you file a complaint with the Department of Housing and Community Development (HCD) for a Utility Bill issue which the HCD cannot assist you with, this is an information only exercise for the HCD. This provides an important paper trail that will be required at a later date.

History of Utilities Overbilling – 11 Years Ago in Arizona

Price Gouging Cited in High Electric Bills

Tue, Sep 5, 2006 – Phoenix, AZ – Expensive electricity bills are hitting residents of mobile homes and recreational vehicles in Arizona especially hard.

Some of the bills are being calculated at twice the rates charged to single-family houses.

‘There are many RV parks that are flat out price-gouging their tenants, and I think it needs to stop,’ said Corporation Commissioner Kris Mayes. ‘To be profiteering on electricity in the middle of the summertime is completely objectionable.’

Some manufactured-home residents, such as Scott Yount of Tempe, are taking matters into their own hands. He flipped off the streetlight in front of his trailer and padlocked the switchbox because he thinks he was paying to light the roadway.

The 48-year-old has been living in the 359-unit Chaparral Mobile Village for nearly 10 years. He said he started becoming troubled several months ago when his bill was higher than his next-door neighbor’s.

‘I keep my AC at 80, with a floor fan on, and at night there’s maybe one light bulb and a TV,’ said Yount, who lives alone. ‘Meanwhile, they have kids running everywhere and their bills were consistently lower by at least 50 percent or more.’

Abe Arrigotti, president of the California company that manages the Chaparral park along with 28 other parks, said he did not believe that was true. ‘If it was true, we would be happy to send an electrician out to fix the problem,’ he said.

Even so, many other residents face similar billing issues but are too scared or financially strapped to do anything, said attorney William Spence, a family practice attorney from Chandler. He says he speaks with frightened mobile-home-park residents almost daily.

Mayes is now asking her fellow commissioners to help solve the problem and is seeking to implement statewide legislation to curb such practices.

Arizona Daily Star

Laco Mobile Home Park – Kort & Scott Replacing Sewer System

Wed, Feb 15, 2017 – On Tue, Feb 7, 2017, residents of Laco Mobile Home Park in Carson, California, received a letter from Hector Ceja, Community Manager, that the park sewer system is being replaced. Work is scheduled to begin on Mon, Feb 13, 2017 and is expected to last for approximately two (2) months.

According to online records, Laco Mobile Home Park was built in 1964 and has 94 spaces. The letter from the Community Manager stated that no work had been done to the park’s sewer system since it was built. Kort & Scott purchased Laco Mobile Home Park and Carson Gardens Trailer Lodge in Jul 2015.

This type of park infrastructure maintenance is something we rarely see in parks owned by Kort & Scott and managed by Sierra Corporate Management (A Kort & Scott Company). The MHPHOA have been informed that the park may have been violated by the HCD for sewage issues leading to the decision to replace the sewer system.

Laco Mobile Home Park is a smaller park with two (2) main roads, the project costs would be minimal. Those costs will most likely be passed on to the residents as a “Capital Improvement” pass-through (separate line item) when the next rent increase request is submitted to the City of Carson Mobilehome Park Rental Review Board.

Potential Failure to Maintain Lawsuit (FTM) Avoided?

One of the main complaints from residents in Kort & Scott owned mobile home parks are sewage issues. The Civil Lawsuits being filed and won by residents, usually contain a Cause of Action for Nuisance which states…

Defendants maintained both a per se public nuisance and a common-law nuisance on their property by substantially failing to provide and maintain the Park’s common areas, facilities, services, and physical improvements in good working order and condition.

1. The Park’s sewer system spills sewage needlessly endangering the safety of the public and residents. This sewage flows down streets, in front of homes and onto some of the lots. The poor maintenance of the sewage system has also caused sewage to back-up inside residents’ homes. The smell of sewage goes inside residents’ homes and can be smelled throughout the Park. Sewage spill and/or backups have resulted in damage to residents’ homes and personal property.

If you live in a mobile home park owned by Kort & Scott and managed by Sierra Corporate Management and are experiencing sewer system problems, contact the California Department of Housing and Community Development (HCD) at 1-800-952-5275 for immediate assistance. Sewage problems are major Health and Safety Code (HSC) violations which fall under the HCD’s jurisdiction and are normally classified as emergencies.

File an HCD Complaint Online

Each resident affected by sewage problems should submit a complaint to HCD. For example, if you have 100 spaces and there are 10 homeowners experiencing problems, each of those 10 homeowners should submit a complaint. You can use the same complaint information (cut and paste) but each complaint submission must have a different homeowner’s name and address. The more complaints received by the HCD, the more urgent the situation becomes.

Laco Mobile Home Park

- Address: 22325 South Main Street, Carson, California 90745

- County: Los Angeles

- Phone: 310-835-7313

- Spaces: 94

- Type: Family

- 2017 Space Rent: $340-$398

- Purchased: Jul 2015

- Management: Sierra Corporate Management

- DBA: Carson GP LLC, Carson MHP Associates LP

- DBA Filing: May 2015

Tue, Feb 14, 2017 – The MHPHOA would like to bring your attention to California Health and Safety Code §18250 shown below in its entirety. We’ve separated and underlined the sentence of interest, note the word entitled which in legal terms means...

An individual’s right to receive a value or benefit provided by law, in this instance, the protection of the investment of their manufactured homes and mobilehomes.

The Allegiance respectfully request that you not overlook Health and Safety Code §18250 when doing business in the State of California. Mobile home owners do have some legal protections in place.

California Health and Safety Code §18250

The Legislature finds and declares that increasing numbers of Californians live in manufactured homes and mobilehomes and that most of those living in such manufactured homes and mobilehomes reside in mobilehome parks. Because of the high cost of moving manufactured homes and mobilehomes, most owners of manufactured homes and mobilehomes reside within mobilehome parks for substantial periods of time.

Because of the relatively permanent nature of residence in such parks and the substantial investment which a manufactured home or mobilehome represents, residents of mobilehome parks are entitled to live in conditions which assure their health, safety, general welfare, and a decent living environment, and which protect the investment of their manufactured homes and mobilehomes.

Knolls Lodge Mobile Home Park – 27% Turnover Since Jan 2015

Mon, Feb 13, 2017 – Kort & Scott purchased Knolls Lodge Mobile Home Park, now a family park (previously 55+) with 257 spaces located at 23701 South Western Avenue, Torrance, California 90501 in Circa 2003.

In 2002, before the Kort & Scott purchase, space rents for Knolls Lodge Mobile Home Park were averaging $400 per month. Since 2003, after the Kort & Scott purchase, mobile home space rents have aggressively risen to $1,450, that’s a 263% increase in space rent in fourteen (14) years.

Space Rent Increases 2003-2017 Kort & Scott Purchase: Circa 2003

Space Rent Note: 2017 Space Rents are advertised at $1,450. Our line chart below is based on a long-term lease agreement with a minimum 6.0% annual increase. In this instance, a credit is shown on the rent statement offsetting the base rent e.g. $1,575 - $150 = $1,425 actual space rent.

Online records indicate that 49 mobile homes have listed for sale since Jan 8, 2016, that’s 19% of the park in one (1) year. Our “limited” dataset shows that at least 35% of Knolls Lodge Mobile Home Park’s mobile homes have sold since Jan 2013.

This exodus of mobile home owners is happening throughout Kort & Scott mobile home parks in the States of California, Arizona, Colorado and New Mexico.

Data Note: We have included eviction data cross referenced to a space number. There are a number of evictions that are not included, we have not cross referenced space numbers as of this date.

After mapping all of the “limited” data publicly available, it appears that Knolls Lodge Mobile Home Park has experienced at least an 80% turnover (205/257 spaces) since the Kort & Scott purchase in circa 2003.

Knolls Lodge Mobile Home Park

- Address: 23701 South Western Avenue, Torrance, California 90501

- County: Los Angeles

- Phone: 310-326-1000

- Spaces: 257

- Type: Family

- 2017 Space Rent: $1,450

- Refinanced: Jun 2005, Amount: $94,700,000, 4/6 MHP Package

Loan Type: Fannie Mae FRM, Chad Thomas Hagwood - Refinanced: Dec 2013, Amount: $158,000,000, 4/8 MHP Package

Loan Type: Fannie Mae FRM, Chad Thomas Hagwood - Management: Sierra Corporate Management

- DBA: Knolls Lodge GP Corp, Knolls Lodge LP

- DBA Filing: Jan 2002, Oct 2002

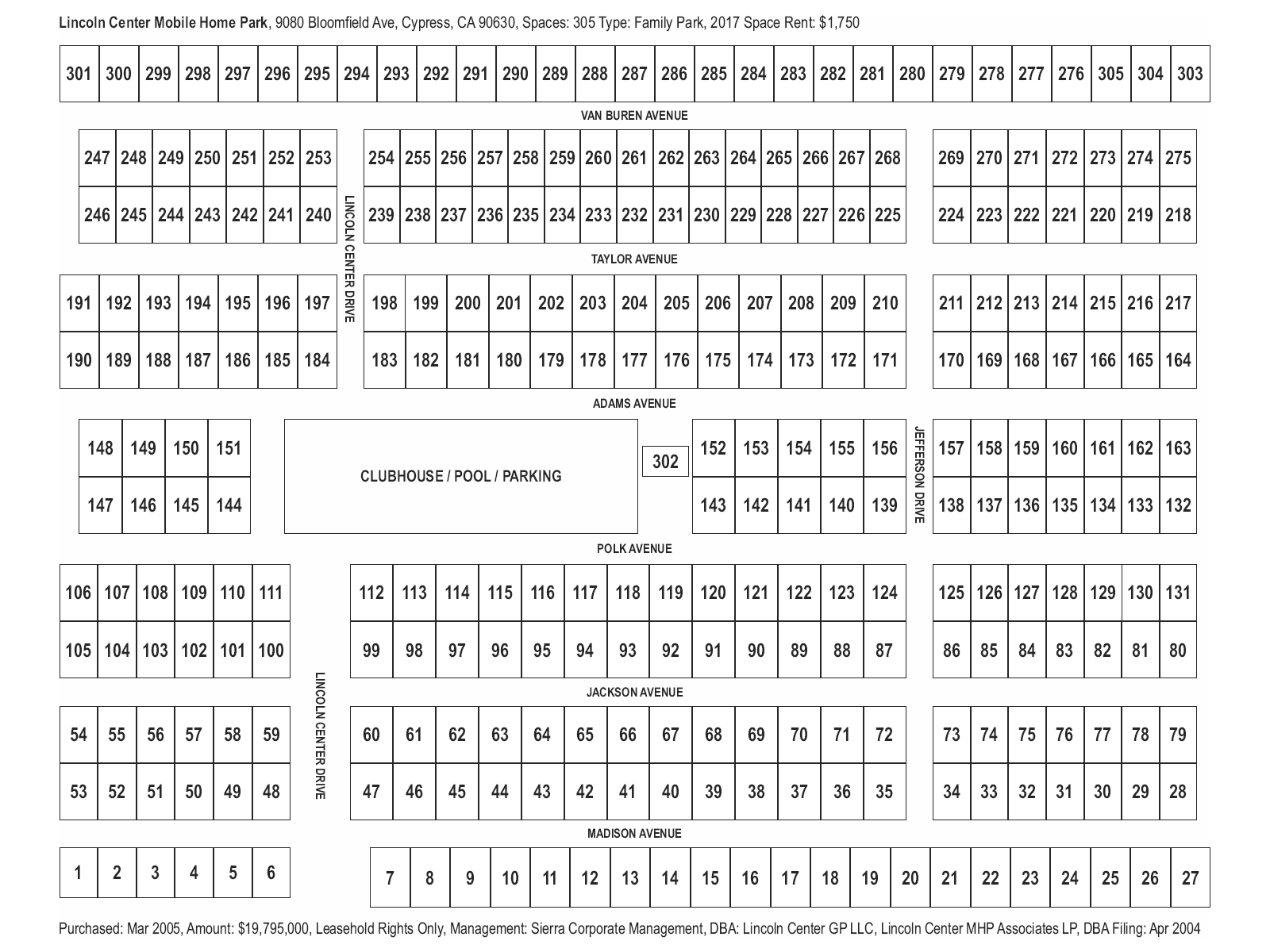

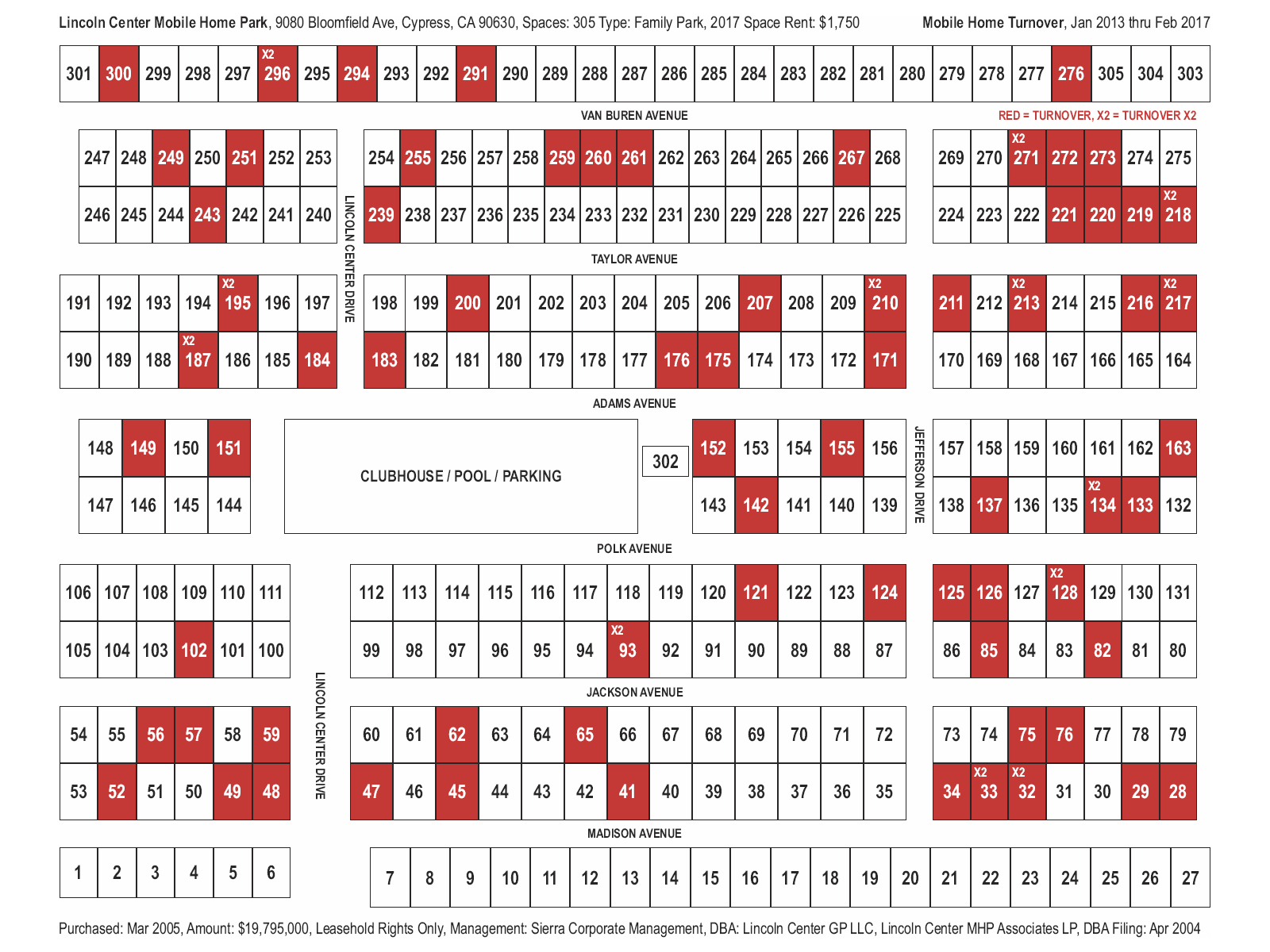

Lincoln Center Mobile Home Park – 17% Turnover Since Jan 2016

Sun, Feb 12, 2017 – Kort & Scott purchased Lincoln Center Mobile Home Park, a family park with 304 spaces located at 9080 Bloomfield Avenue, Cypress, California 90630 in Mar 2005 for $19,795,000 (Leasehold Only).

In Jan 2005, before the Kort & Scott purchase, space rents for Lincoln Center Mobile Home Park were averaging $641 per month. Since Mar 2005, after the Kort & Scott purchase, mobile home space rents have aggressively risen to $1,750, that’s a 173% increase in space rent in twelve (12) years.

Space Rent Increases 2000-2017 Kort & Scott Purchase: Mar 2005

Online records indicate that 53 mobile homes have listed for sale since Jan 8, 2016, that’s 17% of the park in one (1) year. Our limited data shows that at least 30% of Lincoln Center Mobile Home Park’s mobile homes have sold since Jan 2013.

This exodus of mobile home owners is happening throughout Kort & Scott mobile home parks in the States of California, Arizona, Colorado and New Mexico.

Lincoln Center Mobile Home Park

- Address: 9080 Bloomfield Avenue, Cypress, California 90630

- County: Orange

- Phone: 714-826-6211

- Spaces: 305

- Type: Family

- 2017 Space Rent: $1,750

- Purchased: Mar 2005, Amount: $19,795,000, Leasehold Rights Only

- Refinanced: Dec 2013, Amount: $158,000,000, 6/8 MHP Package

Loan Type: Fannie Mae FRM, Chad Thomas Hagwood - Management: Sierra Corporate Management

- DBA: Lincoln Center GP LLC, Lincoln Center MHP Associates LP

- DBA Filing: Apr 2004

- Ground Lease: Oct 1984, Lincoln Center Mobile Home Park LP (Bendetti Co)

Rancho Huntington Mobile Home Park – 46% Turnover Since Jan 2013

Fri, Feb 10, 2017 – Kort & Scott purchased Rancho Huntington Mobile Home Park, a senior park (55+) with 194 spaces located at 19361 Brookhurst Street, Huntington Beach, California 92646 in late 2012 for $25,400,000.

In Jan 2006, space rents in Rancho Huntington were advertised at $500 per month. In Jan 2013, shortly after the Kort & Scott purchase, space rents were advertised at $1,000 per month. As of Feb 2017, mobile home space rents are now advertised at $1,908 per month, that’s a 91% increase since purchase. Overall, the Seniors in Rancho Huntington Mobile Home Park have experienced a 282% increase in space rent in 10 years.

Rancho Huntington is classified as a Senior Park (55+). Prospective buyers must prove income at least 3 times the space rent e.g. $1,908 x 3 = $5,724. How many Seniors do you know claim that type of income?

Online records indicate that 43 mobile homes have listed for sale since Jan 29, 2016, that’s 22% of the park in one (1) year. Our data shows that at least 46% of Rancho Huntington Mobile Home Park’s mobile homes have sold since Jan 2013 with at least 7% of them having sold twice (Same Space Turnover).

This exodus of mobile home owners is happening throughout Kort & Scott mobile home parks in the States of California, Arizona, Colorado and New Mexico.

Space Rent Increases 2006-2017 Kort & Scott Purchase: Circa 2012/2013

Rancho Huntington Mobile Home Park – Converted to All Ages Community

Sun, Jan 1, 2017 – Kort & Scott purchased Rancho Huntington Mobile Home Park, a 55+ community, in late 2012 for $25.4MM. Shortly after purchase, residents were informed that the park would be changing from 55+ to an all ages community. Residents formed a group and took their concerns to the Huntington Beach City Council.

On Mon, Mar 17, 2014, the City of Huntington Beach passed Ordinance No. 4019 which provided a “SR Senior Residential Overlay” to protect the seniors from predatory park owners like Kort & Scott who were/are attempting to convert the 55+ parks to all age communities.

- 2013-08-05 – HB Chapter 228 SR Senior Residential Overlay District

- 2014-03-17 – HB Ordinance No. 4019

- HUD HOPA Questions and Answers

- 1999-04-02 – Implementation of Housing for Older Persons Act of 1995 (HOPA)

Based on publicly available information, it appears that Rancho Huntington Mobile Home Park is no longer a 55+ community. Since the ordinance was passed, Kort & Scott have slowly converted the park to all ages in what appears to be a direct violation of the ordinance. See also mobile homes advertised for sale as Family Listings by Blue Carpet Manufactured Homes in Rancho Huntington Mobile Home Park.

We’ve included two (2) recent articles showing the history of Rancho Huntington Mobile Home Park and how the senior residents have been subjected to the egregious predatory business model of Kort & Scott.

Disclaimer: Kort & Scott may have applied to be removed from the SR Senior Residential Overlay Ordinance No. 4019 and changed their status to an all ages community. The MHPHOA will be obtaining verification of the park’s proper conversion from 55+ to all ages, we will post updates when confirming information becomes available.

Rancho Huntington Mobile Home Park – Space Rent: $1,908 Per Month

Fri, Aug 26, 2016 – Huntington Beach, California: Kort & Scott Financial Group (KSFG) purchased Rancho Huntington Mobile Home Park in 2012 for $25,400,000 (Fannie Mae ARM).

In January 2006, space rents were advertised at $500 per month. In January 2013, space rents were advertised at $1,000 per month. As of August 2016, mobile home space rents are now advertised at $1,908 per month, that’s a 91% increase in three (3) years and a 280% increase in ten (10) years.

Rancho Huntington Mobile Home Park was a senior park at the time of the KSFG purchase. Prospective mobile home buyers are expected to prove income of 3x the current space rent which equals $5,724.

Huntington Beach’s Mobile Home Uprising – Which Side Are YOU On?

Sun, Aug 3, 2014 – When the homeowners are driven out by sudden, exorbitant rent increases – as seems to be the actual goal of owners like Saunders LLC or Kort & Scott – they technically have the option of attempting to sell their homes so they can afford to live somewhere else. BUT, incredibly, the park owner has the right to refuse any buyer who doesn’t pass their absurd and arbitrary approval process. So eventually the homeowner, no longer a homeowner, is forced to abandon their property, which becomes the property of the park owner, and the senior shuffles off in shame and penury, sometimes never to be heard from again.

When I trekked a couple miles northeast to Rancho Huntington near the Fountain Valley border, the park under the occupation of Buena Park tycoons Kort & Scott, the park known as the hotbed of HB mobile home activism, I met or heard tell of: 1. A nearly-senile lady who was so shaken by the new owners’ strong-arm tactics that she panicked and sold her expensive home at a fraction of its worth; 2. More than one chipper lady in their 70’s who are now looking for work so they can pay their new exorbitant rents; 3. TWO MORE World War II Vets not as well off as Pacific’s Alvarez, who are really in danger of going homeless any month.

Rancho Huntington Mobile Home Park

- Address: 19361 Brookhurst Street, Huntington Beach, California 92646

- County: Orange

- Phone: 714-962-7311

- Spaces: 194

- Type: All Ages (Previously 55+ Circa 2015)

- 2017 Space Rent: $1,908

- Purchased: 2012, Amount: $25,400,000

Loan Type: Fannie Mae ARM, Chad Thomas Hagwood - Management: Sierra Corporate Management

- DBA: Rancho Huntington GP LLC, Rancho Huntington Owner LP

- DBA Filing: Aug 2012

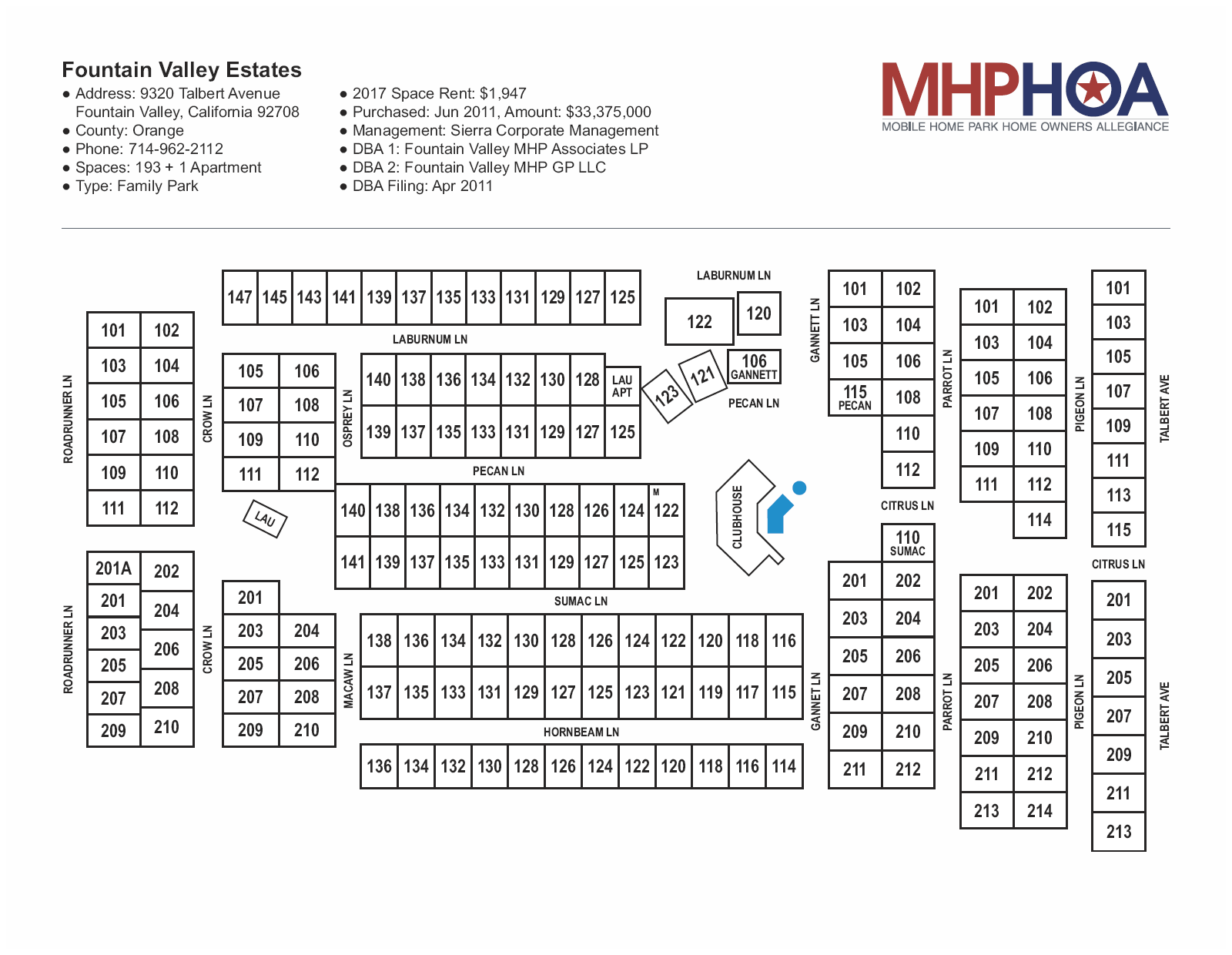

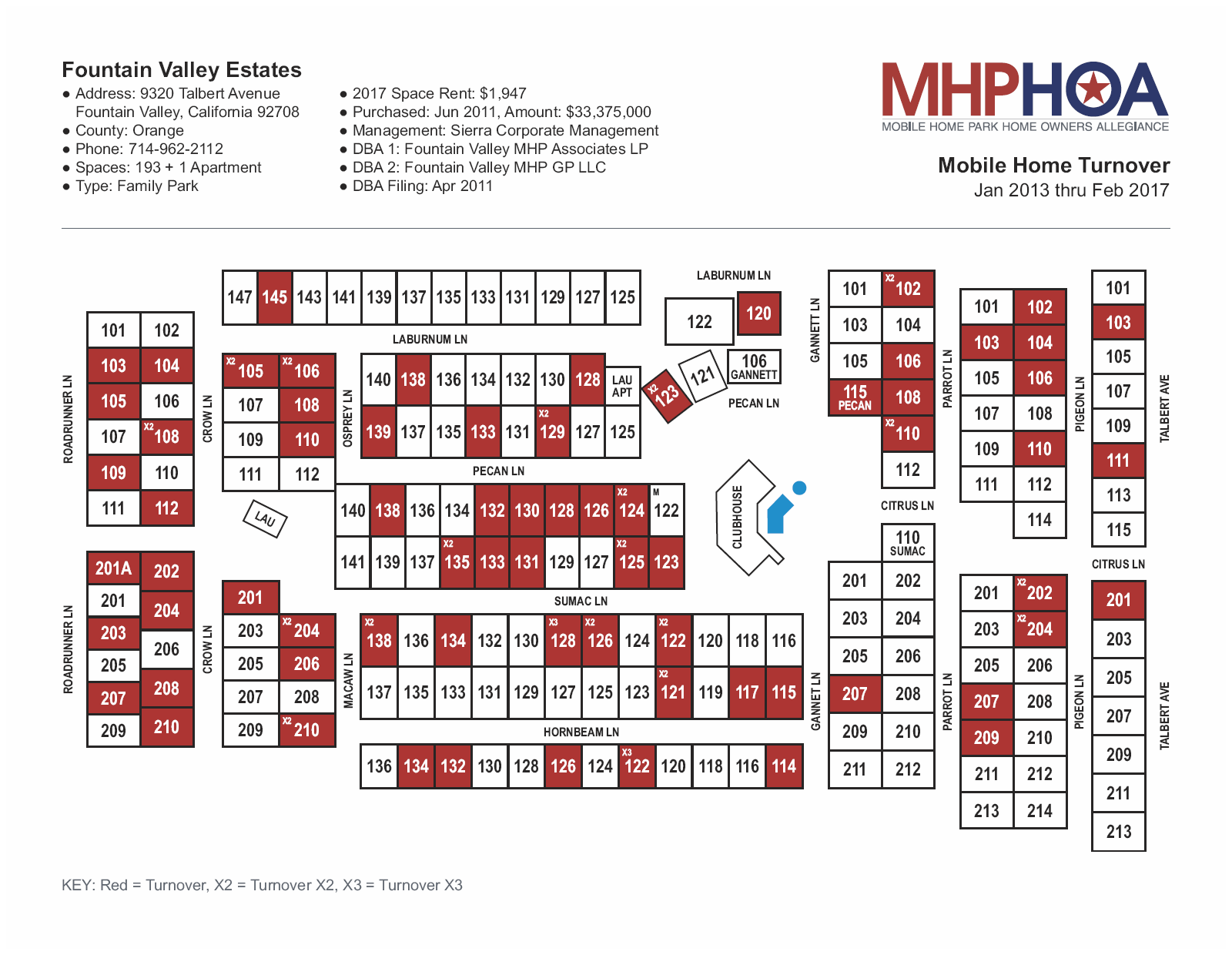

Fountain Valley Estates – 38% Turnover Since Jan 2013

Thu, Feb 9, 2017 – Kort & Scott purchased Fountain Valley Estates, a family park with 193 spaces located at 9320 Talbert Avenue, Fountain Valley, California 92708 in Jun 2011 for $33,375,000.

In Jan 2011, space rents for Fountain Valley Estates (FVE) were advertised at $1,150 per month. Since then, space rents have aggressively risen to $1,350, $1,600, $1,750 and in Nov 2016, a mobile home listed for sale with a space rent of $1,947, that’s a 69% increase in space rent in less than 6 years.

Space Rent Increases 2010-2017 Kort & Scott Purchase: Jun 2011

What happens when space rents are egregiously increased in this manner? The MHPHOA have researched and confirmed 92 mobile home for sale listings in FVE since Jan 2013. It appears that 18 of those 92 mobile homes have sold twice during that time period (Same Space Turnover). 92-18=74 which is 38% of the 193 spaces that have turned over from Jan 2013 to Feb 2017.

On Thu, Nov 3, 2016, a mobile home listed for sale in Fountain Valley Estates. On Sat Oct 24, 2015, that same mobile home was sold to the current owner. This homeowner purchased a mobile home with a 1 year rent special. The homeowner was shocked when they received their first annual rent increase, it forced them to put the mobile home up for sale 1 year after purchase.

The amount they originally paid for their mobile home is what the MHPHOA refer to as a non-refundable deposit. This homeowner may end up selling their home to a Kort & Scott Affiliate for a fraction of what the home is worth and they will most likely incur a financial loss – this is the Kort & Scott Business Model.

Fountain Valley Estates

- Address: 9320 Talbert Avenue, Fountain Valley, California 92708

- County: Orange

- Phone: 714-962-2112

- Spaces: 193 + 1 Apartment

- Type: Family Park

- 2017 Space Rent: $1,947

- Purchased: Jun 2011, Amount: $33,375,000

- Management: Sierra Corporate Management

- DBA: Fountain Valley MHP Associates LP, Fountain Valley MHP GP LLC

- DBA Filing: Apr 2011

Hollydale Mobile Home Park – 44% Turnover Since Feb 2015

Wed, Feb 8, 2017 – The MHPHOA have been reviewing gigabytes of data regarding Kort & Scott including but not limited to; Civil Lawsuits (10+), Small Claims Lawsuits (50+), Unlawful Detainer Lawsuits (600+) and Mobile Home Sales (950+) in the Kort & Scott mobile home inventory.

While reviewing the data en masse, a timeline of events start to appear, stories begin to emerge, a predatory business model begins to take shape and is exposed. All of the Kort & Scott mobile home parks in California are experiencing a wide range of issues. There are a number of mobile home parks that raise red flags when running our reports and one of those is Hollydale Mobile Home Park, 1 of 33 mobile home parks in California owned by a Kort & Scott company and managed by Sierra Corporate Management.

The Hollydale Nightmare

Hollydale Mobile Home Park is a family park with 134 spaces located at 5700 Carbon Canyon Road, Brea, California 92823. The 2016 space rent is currently at $1,650 based on sales listings online. Hollydale Mobile Home Park (Space 53) was the previous corporate headquarters for Sierra Corporate Management.

Online records indicate that the residents of Hollydale Mobile Home Park won a 2009 Civil Lawsuit against the Kort & Scott DBA that owns their mobile home park for: Nuisance, Breach of Contract, Breach of the Covenant of Good Faith and Fair Dealing, Prima Facie Tort of Willful Conduct, Negligence, Negligence Per Se, Unfair Business Practices, Declaratory and Injunctive Relief.

Since the Civil Lawsuit and other ongoing (in progress) litigation activity, there have been a large number of what appear to be Retaliatory Evictions taking place in the mobile home park.

The Statistics – 44% Turnover in 21 Months

During the 2015 year, there were 17 Unlawful Detainer Lawsuits filed against a total of 29 homeowners and residents – that’s 13% of the 134 spaces in 12 months. Hart | King, A Professional Corporation, the law firm representing Kort & Scott DBAs, litigated all 17 eviction proceedings.

From Aug 2015 thru Nov 2016, 42 mobile homes have listed for sale – that’s 31% of the 134 spaces in 15 months with 34 of those mobile homes listed in 2016.

In total, there have been 59 mobile homes involved in a sale and/or eviction proceeding since Feb 2015 – that’s 44% of the 134 spaces in 21 months.

Hollydale Mobile Home Park

- Address: 5700 Carbon Canyon Road, Brea, California 92823

- County: Orange

- Phone: 714-528-7779

- Spaces: 134

- Type: Family

- 2017 Space Rent: $1,650

- Refinanced: Jun 2005, Amount: $94,700,000, 3/6 MHP Package

Loan Type: Fannie Mae FRM, Chad Thomas Hagwood - Refinanced: Dec 2013, Amount: $158,000,000, 3/8 MHP Package

Loan Type: Fannie Mae FRM, Chad Thomas Hagwood - Management: Sierra Corporate Management

- DBA: Hollydale Lowertier/Partner LP, Hollydale Uppertier/Operating LP

- DBA Filing: Sep 2001

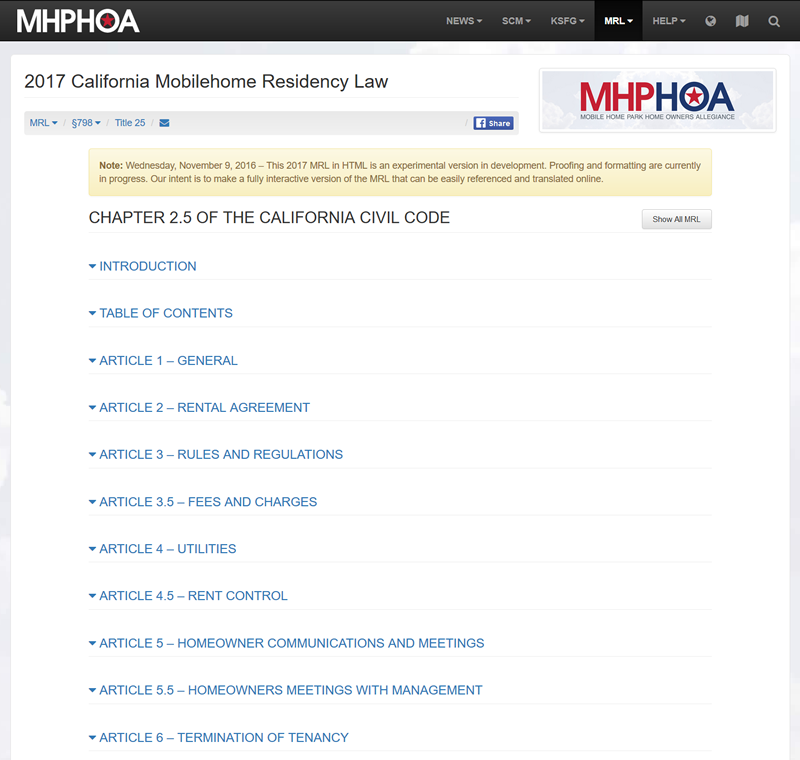

Mon, Feb 6, 2017 – The MHPHOA online version of the 2017 California Mobilehome Residency Law in HTML has been updated to reflect all changes. We’ve also updated the MHPHOA online version of the 2017 California MRL FAQs in HTML.

2017 California Mobilehome Residency Law

Sat, Oct 29, 2016 – 2017 California Mobilehome Residency Law Handbooks are now available.

From the Senate Select Committee on Manufactured Home Communities:

Division 2, Part 2, Chap. 2.5 of the Civil Code. The Mobilehome Residency Law (MRL) is the “landlord-tenant law” for mobilehome parks, which, like landlord-tenant law and other Civil Code provisions, are enforced in a court of law. The Department of Housing and Community Development (HCD) does not have authority to enforce violations of the MRL.

Senate Select Committee on Manufactured Home Communities

From the 2017 MRL Introduction:

For the 2017 edition, there is one new amendment to the Mobilehome Residency Law (see 798.15). The FAQs section has been expanded to include three new questions: the role of county adult protective services (#32.1); an explanation of the difference between trained service dogs and emotional support animals (#35.1); and the legal procedure for sales of abandoned mobilehomes (#63.1). The Index has been expanded, revised and enlarged.

Sun, Feb 5, 2017 – Examples of space rent increases in various California mobile home parks owned by Kort & Scott Financial Group (KSFG) and managed by Sierra Corporate Management (SCM), a Kort & Scott company. These examples were provided by mobile home park residents and are based on actual SCM Rent Statements. Kort & Scott space rent increases are compared to 100% CPI space rent increases. All numbers have been rounded up to the nearest dollar.

Note: Mobile home park listings are in alphabetical order. We will be expanding the charts to include additional mobile home parks and data. If you are a current or past resident living in a mobile home park owned by Kort & Scott and managed by Sierra Corporate Management, and you would like to anonymously contribute space rent increase data for publication on MHPHOA.com, please contact us and provide us with your details e.g. Year/Space Rent. The MHPHOA will perform the 100% CPI calculations for you.

Sat, Feb 4, 2017 – From the 2017 California Mobilehome Residency Law Frequently Asked Questions: Rents, Fees and Taxes, 6. Security Deposit

Resident Question:

Can the park charge first and last months’ rent plus a 2-month security deposit?MRL Answer:

Normally, when a mobilehome owner is accepted for residency in a mobilehome park and signs a rental agreement, charging first month’s rent and a 2-month security deposit are permitted. (Civil Code §798.39) After one full year of satisfactory residency (meaning all rent and fees have been paid during that time), the resident is entitled to request a refund of the 2-month security deposit, or may request a refund at the time he or she vacates the park and sells the home. (Civil Code §798.39(b))

2017 California MRL FAQs

Submit your request for a security deposit refund in writing to Sierra Corporate Management today. The MRL specifically states that SCM must refund your deposit after one full year of satisfactory residency. Do not wait until you vacate the park and/or sell your mobile home.

SCM Long-Term Lease Agreements – Components and Commentary

Fri, Feb 3, 2017 – An online contact request was submitted to the MHPHOA for an all inclusive post regarding the Sierra Corporate Management long-term lease agreements. Here is a repository of links to the data we have available which make up the various components of the long-term lease agreements traps being offered to residents by the Kort & Scott companies (DBAs) that own the mobile home parks.

1. Sierra Corporate Management – Long-Term Lease Agreements

Be very careful when “considering” signing any long-term lease with Sierra Corporate Management (SCM). The standard 15, 20 or 25 year SCM long-term lease agreement may contain a sentence that locks you into a minimum 8.0%, 7.0% or 6.0% yearly space rent increase whether the cost of living (CPI) justifies it or not.

The first paragraph of the Sierra Corporate Management Lease Agreement may read something like this, it is in 12PT ALL CAPS, and should be FAIR WARNING that you are about to give up your homeowners rights if you sign the lease.

This agreement will be exempt from any ordinance, rule, regulation or initiative measure adopted by any Governmental entity which establishes a maximum amount that a landlord may charge a tenant for rent.

2. Sierra Corporate Management – Long-Term Lease Agreement Sample

3. SCM Lease Incentives – $1,000.00 Paid to You Directly in a Check!

The question of “How much is a lease worth to KSFG/SCM?” has arisen many times. We’ve crunched the raw data and have added a new column to our SCM Space Rent Calculator showing your "Lease Value" or what you will pay for your Space Rent for the duration of your lease. The Lease Value also gives us an all-in starting point for the total value of the Lease Receivables.

4. Sierra Corporate Management – Unconscionable MHP Leases

DO NOT SIGN a Kort & Scott Financial Group (KSFG) dba Sierra Corporate Management (SCM) Lease Agreement until you have sought professional and/or legal advice. The MHPHOA believe the long-term lease agreements being offered by Kort & Scott Financial Group (KSFG) dba Sierra Corporate Management (SCM) are Unconscionable Contracts aka Unlawful Contracts. These leases are overly harsh, unduly oppressive, unreasonably favorable and so one-sided as to shock the public conscience.

5. Sierra Corporate Management – Forbearance Agreements

DO NOT SIGN a Kort & Scott Financial Group (KSFG) dba Sierra Corporate Management (SCM) Forbearance Agreement until you have sought professional and/or legal advice. Signing an SCM Forbearance Agreement waives your homeowner’s rights and releases KSFG/SCM from any and all past, present, and/or future liabilities, claims, disputes, controversies, suits, actions, causes of action, loss, debt, damages or injuries (collectively referred to as “claims”), matured or contingent, liquidated or unliquidated, known and unknown, suspected or unsuspected, which TENANT may have against PARK.

6. SCM Space Rent Specials and Addendum Clauses

Did you purchase a park owned or affiliate owned mobile home in a KSFG/SCM mobile home park? We’re you offered a space rent special if you signed a long-term lease agreement? Does your long-term lease agreement contain a lease term section referencing a separately attached Lease Addendum?

Thu, Feb 2, 2017 – The MHPHOA would like to respectfully remind Hart | King Law, Dowdall Law Offices, and all other “culpable” attorneys representing mobile home park owners and practicing law in the State of California, you do have a Rules of Professional Conduct that you must adhere to. If you violate these Rules of Professional Conduct, you may be subject to disbarment.

California is the only state in the nation with independent professional judges dedicated to ruling on attorney discipline cases. The State Bar of California investigates complaints of attorney misconduct. If the State Bar determines that an attorney’s actions involve probable misconduct, formal charges are filed with the State Bar Court by the bar’s prosecutors (Office of Chief Trial Counsel).

The independent State Bar Court hears the charges and has the power to recommend that the California Supreme Court suspend or disbar attorneys found to have committed acts of professional misconduct or convicted of serious crimes.

Also, it can temporarily remove lawyers from the practice of law when they are deemed to pose a substantial threat of harm to clients or the public.

The State Bar Court of California

What is Moral Turpitude

Moral Turpitude is a phrase used in criminal law to describe conduct that is considered contrary to community standards of justice, honesty, or good morals. Turpitude means a corrupt, depraved, degenerate act or practice. Moral turpitude generally refers to conduct that shocks the public conscience.

Disbarment – California Business and Professions Codes §6106 and §6107

-

6106. The commission of any act involving moral turpitude, dishonesty or corruption, whether the act is committed in the course of his relations as an attorney or otherwise, and whether the act is a felony or misdemeanor or not, constitutes a cause for disbarment or suspension.

If the act constitutes a felony or misdemeanor, conviction thereof in a criminal proceeding is not a condition precedent to disbarment or suspension from practice therefor.

- 6107. The proceedings to disbar or suspend an attorney, on grounds other than the conviction of a felony or misdemeanor, involving moral turpitude, may be taken by the court for the matters within its knowledge, or may be taken upon the information of another.

California Business and Professions Code Section 6100-6117

CIMT – Crimes Involving Moral Turpitude

Crimes Against Property: Accessory Before the Fact in Uttering a Forged Instrument, Attempted Fraud, Conspiracy to Commit Forgery, Encumbering Mortgaged Property with Intent to Defraud, Extortion, Forgery, Making False Statements of Financial Condition, Malicious Trespass, Obtaining Money by False Pretenses, Uttering a Forged Instrument

Wed, Feb 1, 2017 – The question of “How much is a lease worth to KSFG/SCM?” has arisen many times. We’ve crunched the raw data and have added a new column to our SCM Space Rent Calculator showing your “Lease Value” or what you will pay for your Space Rent for the duration of your lease. The Lease Value also gives us an all-in starting point for the total value of the Lease Receivables.

The financial incentives (e.g. $500, $1,000) being offered by KSFG/SCM to sign a Long-Term Lease Agreement are a pittance compared to the estimated value of the Lease Receivables.

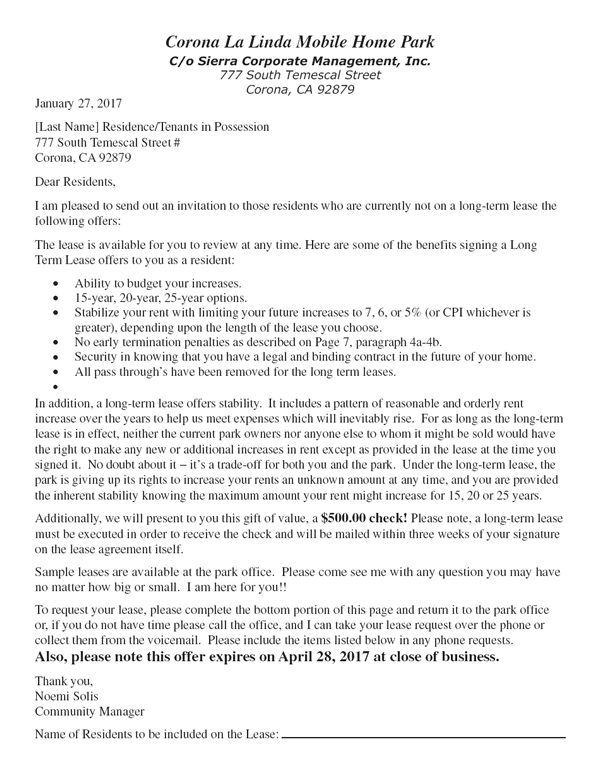

Corona La Linda Mobile Home Park

On Fri, Jan 27, 2017, the residents of Corona La Linda Mobile Home Park received a letter from Sierra Corporate Management, a Kort & Scott company, promoting long-term leases. The gist of the letter sent by Noemi Solis (Community Manager) states that if the residents do not sign the long-term leases, Kort & Scott may subject them to rent increases of unknown amounts at any time.

Under the long-term lease, the park is giving up its rights to increase your rents an unknown amount at any time, and you are provided the inherent stability knowing the maximum amount your rent might increase for 15, 20 or 25 years.

Additionally, we will present to you this gift of value, a $500.00 check! Please note, a long-term lease must be executed in order to receive the check and will be mailed within three weeks of your signature on the lease agreement itself.

The MHPHOA have watched this scenario play out many times over the years. The residents of CLLMHP are in a Catch 22 situation, if they don’t sign the lease, they may be subjected to incessant predatory rent increases. If they do sign the lease, they lock themselves into a 5% per year minimum increase based on the 25-year lease, not to mention the host of homeowner’s rights they may lose when signing anything of this nature from Kort & Scott dba Sierra Corporate Management.

Corona La Linda Mobile Home Park

- Address: 777 South Temescal Street, Corona, California 92879

- County: Riverside

- Phone: 951-734-1094

- Spaces: 132

- Type: Family

- 2017 Space Rent: $950

- Purchased: May 2015, Amount: $16,700,000

Broker: Robert M. Paez, Martinez and Associates - Management: Sierra Corporate Management

- DBA: Corona La Linda Associates LP, Corona La Linda GP LLC

- DBA Filing: May 2015

Stop Predatory Park Owners

MHP News Resources

Kort & Scott Pay $57,000,000

Largest Mobile Home Park Settlement Ever

Fri, Nov 22, 2019 – Kabateck LLP attorneys representing hundreds of low-income mobile home residents in Long Beach, California secured a nearly $57 million settlement, which is the largest settlement ever involving a mobile home park.

MRL Protection Program

Sometimes, in mobilehome parks, disputes can arise between mobilehome/manufactured homeowners and park management. To help resolve some of these disputes, California created the Mobilehome Residency Law Protection Program (MRLPP) through the Mobilehome Residency Law Protection Act of 2018, Assembly Bill 3066 (Chapter 774, Statutes of 2018).

Who Can Submit a Complaint?

Must be a mobilehome / manufactured homeowner residing in a permitted mobilehome park.

What Types of Complaints can be Submitted for Consideration?

Complaints for issues within mobilehome parks related to Mobilehome Residency Law violations (California Civil Code). Common violations include illegal grounds for eviction, failure to provide proper notice of rent increases, or no written rental agreement between the park and mobilehome owner.

How do I submit my complaint?

Complaints must be submitted to HCD. HCD provides assistance to help resolve and coordinate resolution of the most severe alleged violations of the Mobilehome Residency Law. Visit the How to Submit a Complaint page for details on ways to submit your complaint to HCD.